Genius Group Board implements 10 Year Performance Plan for CEO to achieve $1 billion market capitalization

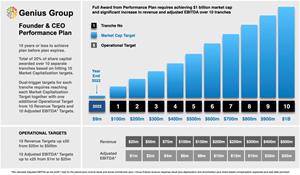

SINGAPORE, Oct. 20, 2023 (GLOBE NEWSWIRE) -- Genius Group Limited (NYSE American: GNS) (“Genius Group” or the “Company”), a leading entrepreneur edtech and education group, announces today that its Board has approved a 10 year performance plan for the Founder & CEO, Roger James Hamilton, to earn share awards across 10 tranches based on achieving market capitalization targets for Genius Group up to $1 billion within 10 years or less.

Qualifying for each of the tranches requires Hamilton to achieve each of the 10 market capitalization targets, together with achieving an additional operational goal related to either annual revenue, from 10 goals up to $500 million, or annual adjusted EBITDA, from 10 goals up to $25 million.

Richard Berman, Chairman of Genius Group’s Audit & Compensation Committees, said “The Board has a strong belief in Roger Hamilton’s ability to grow Genius Group into a billion dollar company delivering a positive, global impact to the future of education. We believe this plan aligns our CEO, management and investors with our long term growth prospects and the value Genius Group can deliver to all long term shareholders.”

Full details of the compensation plan can be found in the company’s filed 6-K.

About Genius Group

Genius Group is a leading entrepreneur Edtech and education group, with a mission to disrupt the current education model with a student-centered, life-long learning curriculum that prepares students with the leadership, entrepreneurial and life skills to succeed. Through its learning platform, GeniusU, the Genius Group has a member base of 5.4 million users in 200 countries, ranging from early age to 100.

For more information, please visit https://www.geniusgroup.net/

Investor Notice

Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks, uncertainties and forward-looking statements described in our most recent Annual Report on Form 20-F, as amended for the fiscal year ended December 31, 2022, filed with the SEC on June 6, 2023 and August 3, 2023. If any of these risks were to occur, our business, financial condition or results of operations would likely suffer. In that event, the value of our securities could decline, and you could lose part or all of your investment. The risks and uncertainties we describe are not the only ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. In addition, our past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results in the future. See "Forward-Looking Statements" below.

Forward-Looking Statements

Statements made in this press release include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the use of words such as “may,” “will,” “plan,” “should,” “expect,” “anticipate,” “estimate,” “continue,” or comparable terminology. Such forward-looking statements are inherently subject to certain risks, trends and uncertainties, many of which the Company cannot predict with accuracy and some of which the Company might not even anticipate and involve factors that may cause actual results to differ materially from those projected or suggested. Readers are cautioned not to place undue reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors under the heading “Risk Factors” in the Company's Annual Reports on Form 20-F, as may be supplemented or amended by the Company's Reports of a Foreign Private Issuer on Form 6-K. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise.

Contacts

Investors:

Flora Hewitt, Vice President of Investor Relations and Mergers and Acquisitions

Email: investor@geniusgroup.net

US Investors:

Dave Gentry

RedChip Companies Inc

1-800-RED-CHIP

GNS@redchip.com

Attachment

Released October 20, 2023