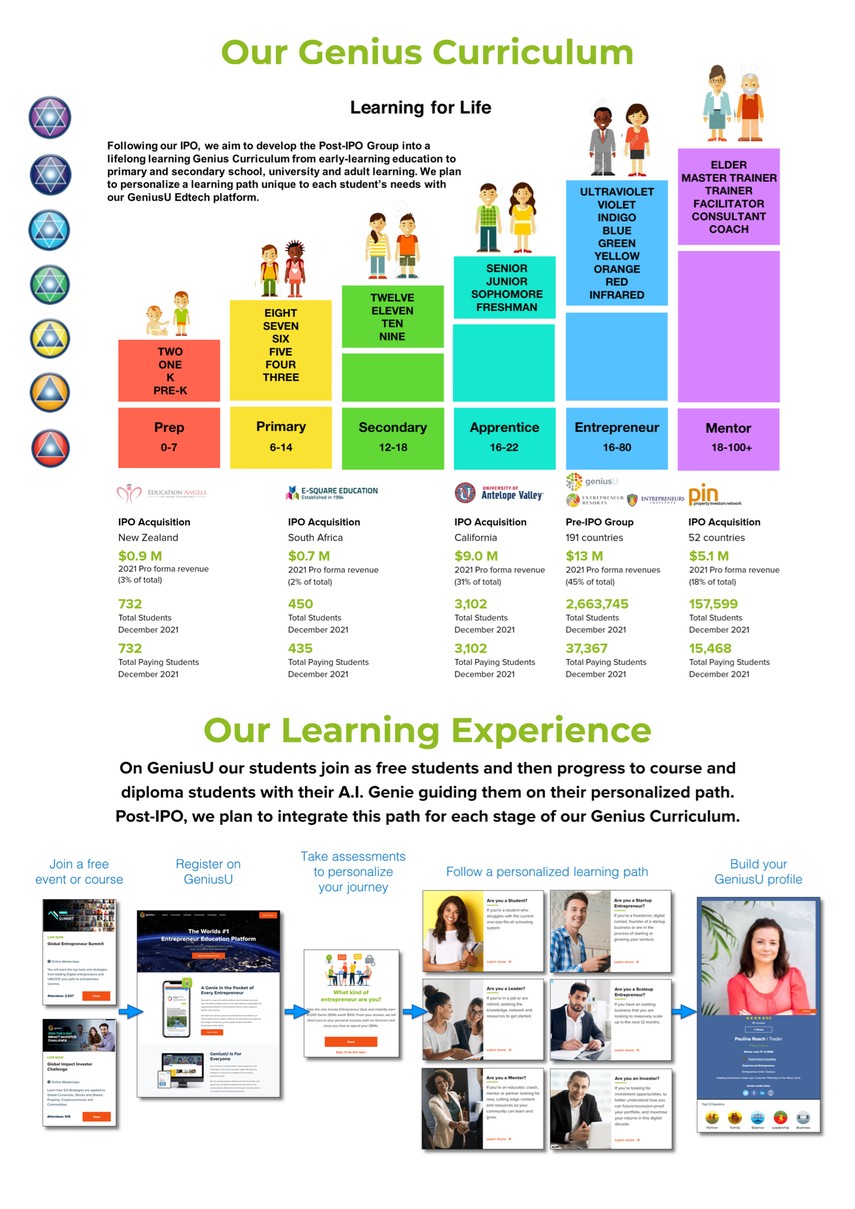

In phase three, from 2025 to 2030, our goal is to have developed a full curriculum accredited and receiving funding from government bodies in the U.S., the U.K., Europe, Asia and Australasia and to be seen as a viable alternative by students, parents, partner schools and companies around the world to the existing education options.

Recent Developments

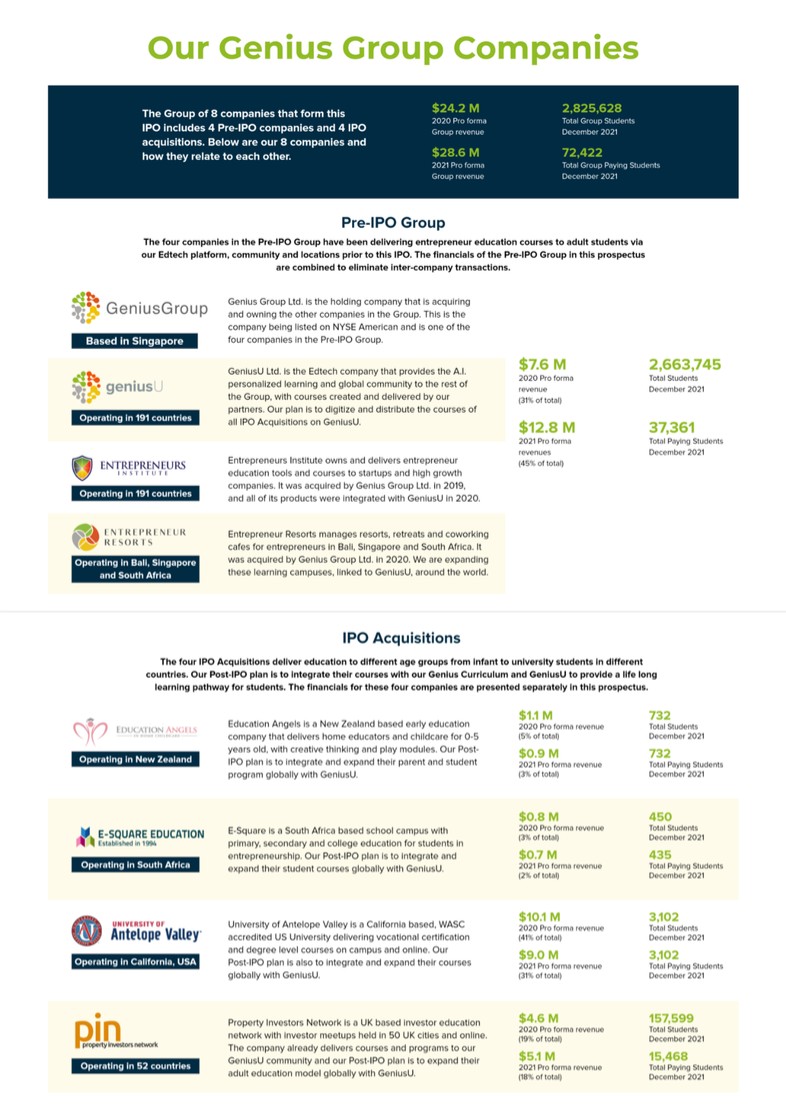

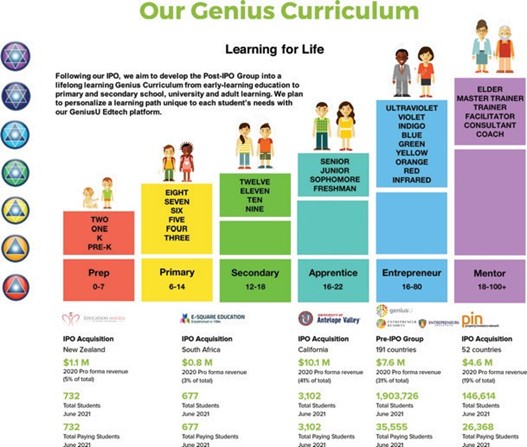

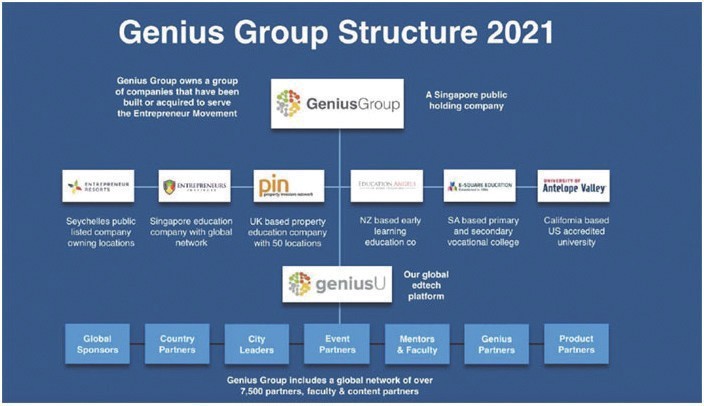

IPO and IPO Acquisitions. On April 14, 2022, we consummated our initial public offering on the NYSE American (ticker: GNS), with the issuance of 3,272,727 ordinary shares at an initial offering price of $6.00 per share. We closed the four IPO Acquisitions, Education Angels, Property Investors Network, E-Square and UAV, as of April 19, 2022, April 30, 2022, May 31, 2022, and July 7, 2022, respectively. See “Further Company Information” below for details regarding closings of the IPO Acquisitions.

Appointment of New Officers. We added new members to our management team in 2022. Mr. Erez Simha has joined the Company’s management team, effective July 18, 2022, as the Chief Financial Officer. Mr. Simha replaced Mr. Jeremy Harris, who had been the Company’s prior Chief Financial Officer for several years. In addition, Mr. Bradley Joseph Warkins and Mr. Ravinder Karwal joined the Company’s management team, effective April 11, 2022, and June 29, 2022, as the Chief Operating Officer and Chief Revenue Officer, respectively. See “Management” for the biographies of the new officers.

Convertible Notes. On August 24, 2022, we entered into a securities purchase agreement (the “Securities Purchase Agreement”) with an institutional investor pursuant to which we sold $18,130,000 aggregate principal amount of senior secured convertible notes to the investor for an aggregate purchase price of $17 million (an aggregate original issue discount of 6%) in a transaction (the “Transaction”) exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The convertible notes are convertible, at the holder’s option, into up to 3,506,770 of our ordinary shares at a fixed conversion price of $5.17, subject to adjustment for stock dividends, stock splits, anti-dilution and other customary adjustment events. The Transaction closed on August 26, 2022. See “Prospectus Summary – Securities Purchase Agreement for the Sale of $18.13 Million Principal Amount of Convertible Notes” for more detailed information.

History and Corporate Structure

The origins of Genius Group began in 2002 when Singapore-based entrepreneur, Roger James Hamilton created the Wealth Dynamics system as a personality profiling tool for entrepreneurs to discover their strengths and weaknesses, and build an entrepreneurial team. Over the next decade the popularity of the tool led to Roger growing Wealth Dynamics into a global company with country licenses around the world and a community of over 250,000 entrepreneurs by 2012.

Through the global financial crisis that commenced in 2008 it became clear to Roger Hamilton, our Chief Executive Officer, and the senior management team of Wealth Dynamics that the number of entrepreneurs and small business owners around the world was growing dramatically and in need of a training system to reduce the number of business failures. According to data from the U.S. Bureau of Labor Statistics, about 20% of U.S. small businesses fail within the first year. By the end of their fifth year, roughly 50% have faltered. After 10 years, only around a third of businesses have survived.

From 2012 to 2015, Genius Group developed a number of initiatives under the Entrepreneurs Institute brand. This included the Global Entrepreneur Summit and Entrepreneur Fast Track Event series, which we believe is now the largest entrepreneur seminar series hosted in 18 countries annually. It also included Talent Dynamics, a corporate version of Wealth Dynamics used by large multinationals, and a full entrepreneur system to grow from startup to the first million dollars in revenue called “The Millionaire Masterplan” which became a New York Times bestselling book in 2014.

During this period, Roger Hamilton also became the founding Chairman of the Green School in Bali. The Green School attracted global attention as a new model of schooling with its environmental and student- centered approach to learning. It won the inaugural “Greenest School in the World” award from the Center for Green Schools at the U.S. Green Building Council, and became a global case study for new models of schooling. It is used as the first example of 21st century schooling in the World Economic Forum’s 2020 white paper on The Future of Schools. The need for an education revolution based on a global, scalable high-tech, high-touch model led to the launch of GeniusU as an Edtech solution in 2015.

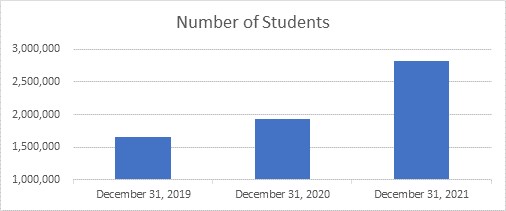

From 2015 to 2017, GeniusU grew rapidly from 313,000 students in the first year to 736,000 students by the third year. During this time, Entrepreneurs Institute had continued to grow and a third company under Roger Hamilton’s majority ownership, Entrepreneur Resorts Limited, had been established to expand on the successful and profitable model of providing entrepreneur retreats and co-