38

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from _____________________ to _____________________

Commission file number:

(Exact name of Registrant as specified in its charter)

n/a

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

C/O Greg Lavelle,

Puglisi & Associates

Telephone:

Email:

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class | Name of each exchange on which registered | |

The |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report: As of December 31, 2021, there were

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| ☐ Yes ☒ |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

| ☐ Yes ☒ |

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| ☐ Yes ☒ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| ☒ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | ☒ |

|

| Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ |

|

| Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

A BRIEF GLOSSARY

To aid in the understanding the entities, acquisitions, products, services and certain other concepts referred to in this Annual Report, the following non-exhaustive glossary of terms is provided:

AI is an abbreviation of Artificial Intelligence and refers to technology that enables machine learning, specifically in the case of Genius Group where our Genie virtual assistant is able to recommend personalized steps for each student based on Genie learning the personal strengths, passions, purpose, preferences and level of each student through their inputs on our Edtech platform.

Certification refers to the digital courses on our GeniusU platform that faculty members take in order to be certified to mentor students on GeniusU, and to be able to add their own courses and products to GeniusU.

City Leader refers to our Mentors who host monthly events in their city to support the Students and Mentors in their local area.

E-Square refers to E-Squared Education Enterprises (Pty) Ltd, a South African private limited company and one of the IPO Acquisitions as defined below.

Edtech is an abbreviation of Educational Technology and refers to technology designed to improve the effectiveness, efficiency and experience of the education process. Genius Group is focused on growing as an Edtech group with the ability to scale rapidly and operate globally.

Education Angels refers to Education Angels in Home Childcare Limited, a New Zealand private limited company and one of the IPO Acquisitions as defined below.

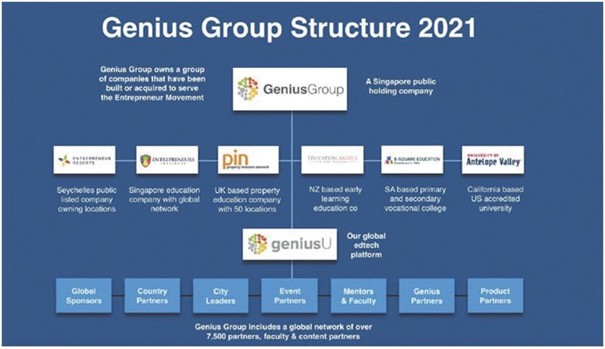

Genius Group (or the Group) refers to the entire group of companies within Genius Group, which include the four companies in the Pre-IPO Group and, following the closing of their acquisitions, the four IPO Acquisitions as defined below.

Entrepreneurs Institute refers to Wealth Dynamics Pte Ltd, a Singapore private limited company and one of the companies in the Pre-IPO Group.

Entrepreneur Resorts refers to Entrepreneur Resorts Limited, a Seychelles public listed company on the Seychelles Merj Stock Exchange (Ticker: ERL). Entrepreneur Resorts was acquired by Genius Group in 2020.

Genius Group Ltd refers specifically to the holding company, Genius Group Limited, the Singapore public limited company which owns the other companies in the Group. Prior to a corporate name change in July 2019, it was known as GeniusU Pte Ltd. For the avoidance of doubt, references in this Annual Report to Genius Group Ltd with respect to periods prior to its July 2019 name change should be understood as references to the company as operated under its previous name.

GeniusU Ltd refers to the company formed in August 2019 under the corporate name GeniusU Pte Ltd, and subsequently converted to a public company, GeniusU Ltd in May 2021 (as distinct from its parent Genius Group Ltd, the current Group holding company, which until July 2019 used the name GeniusU Pte Ltd).

GeniusU, when used without any corporate suffix or otherwise not as part of a corporate name, refers to the Edtech platform including website, mobile app, AI system, data and software system under the GeniusU brand.

IASB refers to International Accounting Standards Board.

IFRS refers to International Financial Reporting Standards as issued by IASB.

IPO refers to the initial public offering of our ordinary shares that was consummated on April 14, 2022.

IPO Acquisitions refers to the four companies that we plan to acquire following our IPO. As of May 13, 2022, the acquisitions of Education Angels and Property Investors Network have closed and the acquisitions of E-Square and University of Antelope Valley are pending.

Mentor refers to our faculty members who have taken and passed Certifications on GeniusU.

microcamp refers to courses that are a combination of digital content on our GeniusU Edtech platform and live in-person courses conducted with our Mentors.

microdegree refers to the digital courses on our GeniusU Edtech platform. These are a combination of video, audio and text-based learning with assessments and exercises that students can take in their own time, on their own or with the guidance of our faculty.

microschool refers to the scheduled, live digital courses on our GeniusU Edtech platform. These are similar in format to microdegrees but differ in that they are conducted live together with other students and the guidance of our faculty, with live interaction, feedback and challenge-based presentations, competitions and awards.

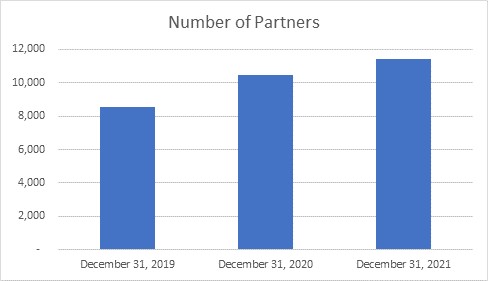

Partners refer to all individuals who are creating, marketing delivering or hosting courses on GeniusU and PIN, and all faculty members delivering courses in all other Group companies.

Pre-IPO Group refers to the four companies which were already operating as a group in 2020 prior to our IPO on 14 April 2022, namely Genius Group Ltd, GeniusU Ltd, Entrepreneurs Institute and Entrepreneur Resorts.

Property Investors Network (or PIN) refers to Property Investors Network Ltd combined with its sister company Mastermind Principles Limited, a United Kingdom (“U.K.”) private limited company and one of the IPO Acquisitions as defined above.

students refer to all individuals who have registered for courses in our Group companies. This is further divided into Free Students, who have registered for free courses, and Paying Students, who have registered and paid for courses.

University of Antelope Valley (or UAV) refers to University of Antelope Valley, Inc., a California corporation and one of the IPO Acquisitions as defined above.

TABLE OF CONTENTS

Page | |

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 6 |

6 | |

6 | |

6 | |

10 | |

10 | |

10 | |

36 | |

36 | |

43 | |

104 | |

108 | |

109 | |

109 | |

109 | |

122 | |

127 | |

127 | |

127 | |

131 | |

131 | |

133 | |

133 | |

135 | |

136 | |

136 | |

136 | |

137 | |

138 | |

138 | |

138 | |

139 | |

139 | |

139 | |

139 | |

139 | |

139 | |

139 | |

139 | |

139 | |

139 | |

139 | |

140 | |

141 | |

142 | |

144 | |

144 | |

145 | |

145 | |

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 145 |

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 145 |

146 | |

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 146 |

146 | |

146 | |

B. Management’s Annual Report on Internal Control over Financial Reporting | 146 |

C. Attestation Report of the Registered Public Accounting Firm | |

147 | |

147 | |

147 | |

147 | |

148 | |

ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 148 |

ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 148 |

149 | |

149 | |

149 | |

ITEM 16I. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | 149 |

150 | |

150 | |

150 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements regarding our current expectations or forecasts of future events. All statements other than statements of historical facts contained in this Annual Report, including statements regarding our future results of operations and financial position, business strategy, the GeniusU Platform, technology development plans, research and development costs, timing and likelihood of success, as well as plans and objectives of management for future operations are forward-looking statements. Many of the forward-looking statements contained in this Annual Report can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate,” “will” and “potential,” among others.

Forward-looking statements appear in a number of places in this Annual Report and include, but are not limited to, statements regarding our intent, belief or current expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including, but not limited to, those identified under “Item 3. Key Information—D. Risk Factors.” These forward-looking statements include:

| ● | our ability to compete in the highly competitive markets in which we operate, and potential adverse effects of this competition; |

| ● | our ability to maintain revenues if our products and services do not achieve and maintain broad market acceptance, or if we are unable to keep pace with or adapt to rapidly changing technology, evolving industry standards and changing regulatory requirements; |

| ● | uncertainty, downturns and changes in the markets we serve; |

| ● | our expectations regarding the size of the global education market, Edtech market and the various geographic and demographic markets that our group of companies serve; |

| ● | our competitiveness in the marketplace in relation to existing and new competitors in the marketplace; |

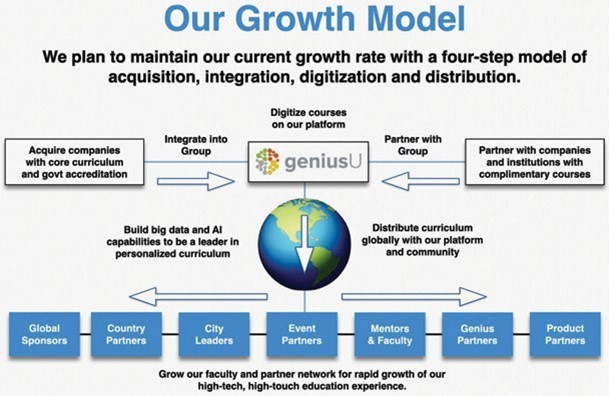

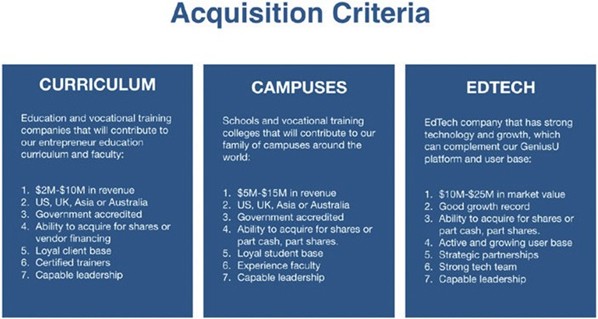

| ● | our commercialization strategy, including our plans to acquire education companies, to combine them in a global curriculum and Edtech platform, and to digitize and distribute our courses globally; |

| ● | our belief that we will be able to drive commercialization of our GeniusU Edtech platform through the growth of our A.I., and technology development; |

| ● | our ability to integrate effectively our Pre-IPO Companies and IPO Acquisitions in order to expand their product range and improve their financial performance; |

| ● | the willingness of our Partners, Mentors and Students to adopt GeniusU as their Edtech platform of choice; |

| ● | our ability to effectively manage our anticipated growth; |

| ● | the timing, scope or likelihood of regulatory submissions, filings, approvals, authorizations or clearances; |

| ● | our ability to repay or service our debt obligations and meet the financial covenants related to such debt obligations; |

| ● | our ability to enforce our intellectual property rights and to operate our business without infringing, misappropriating, or otherwise violating the intellectual property rights and proprietary technology of third parties; |

| ● | our ability to develop effective internal controls over financial reporting; |

| ● | our ability to attract, motivate and retain qualified employees, including members of our senior management team; |

| ● | the effects of the COVID-19 pandemic, including mitigation efforts and economic effects, on any of the foregoing or other aspects of our business or operations; |

| ● | the effects of the Russia-Ukraine Conflict, including mitigation efforts and economic effects, on any of the foregoing or other aspects of our business or operations; |

| ● | our expectations regarding the time during which we will be an emerging growth company under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and a foreign private issuer; |

| ● | the future trading price of common shares and impact of securities analysts’ reports on these prices; |

| ● | our ability to fully derive anticipated benefits from existing or future acquisitions, joint ventures, investments or dispositions; |

| ● | exchange rate fluctuations and volatility in global currency markets; |

| ● | potential adverse tax consequences resulting from the international scope of our operations, corporate structure and financing structure; and |

| ● | increased risks resulting from our international operations. |

1

These forward-looking statements speak only as of the date of this Annual Report and are subject to a number of risks, uncertainties and assumptions described under the sections of this Annual Report titled “Item 3. Key Information—D. Risk Factors” and “Item 5. Operating and Financial Review and Prospects” and elsewhere in this Annual Report. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

SUMMARY OF RISK FACTORS

The following is a summary of certain, but not all, of the risks that could adversely affect our business, operations and financial results. If any of the risks actually occur, our business could be materially impaired, the trading price of our common shares could decline, and you could lose all or part of your investment.

Risks Related to Our Business and Industry (All Group companies)

➢ | We are a global business subject to complex economic, legal, political, tax, foreign currency and other risks associated with international operations, which risks may be difficult to adequately address. |

➢ | Our growth strategy anticipates that we will create new products, services, and distribution channels and expand existing distribution channels. If we are unable to effectively manage these initiatives, our business, financial condition, results of operations and cash flows would be adversely affected. |

➢ | Our growth may have a negative effect on the successful expansion of our business, on our people management, and on the increase in complexity of our software and platforms. |

➢ | If our growth rate decelerates significantly, our prospects and financial results would be adversely affected, preventing us from achieving profitability. |

➢ | We may be unable to recruit, train and/or retain qualified teachers, Mentors, and other skilled professionals. |

➢ | Our business may be materially adversely affected if we are not able to maintain or improve the content of our existing courses or to develop new courses on a timely basis and in a cost-effective manner. |

➢ | Failure to attract and retain students to enroll in our courses and programs, and to maintain tuition levels, may have a material adverse impact on our business and prospects. |

➢ | If student performance falls or parent and student satisfaction declines, a significant number of students may not remain enrolled in our programs, and our business, financial condition and results of operations will be adversely affected. |

➢ | Our curriculum and approach to instruction may not achieve widespread acceptance, which would limit our growth and profitability. |

➢ | The continued development of our brand identity is important to our business. If we are not able to maintain and enhance our brand, our business and operating results may suffer. |

➢ | If our partnerships are unable to maintain educational quality, we may be adversely affected. |

➢ | There is significant competition in the market segments that we serve, and we expect such competition to increase; we may not be able to compete effectively. |

2

➢ | The COVID-19 pandemic has significantly negatively impacted segments of our business and may continue to do so. |

➢ | Our business and operations may be adversely affected by economic uncertainty and volatility in the financial markets, including as a result of the military conflict in Ukraine. |

➢ | Our business may be materially adversely affected by a general economic slowdown or recession. |

➢ | We may be sued for infringement of the intellectual property rights of others and such actions would be costly to defend, could require us to pay damages and could limit our ability or increase our costs to use certain technologies in the future. |

➢ | We cannot assure you that we will not be subject to liability claims for any inaccurate or inappropriate content in our training programs, which could cause us to incur legal costs and damage our reputation. |

➢ | We may be subject to legal liability resulting from the actions of third parties, including independent contractors and teachers, which could cause us to incur substantial costs and damage our reputation. |

➢ | We may not have sufficient insurance to protect ourselves against substantial losses. |

Risks Related to Our Business and Industry (Specific to Pre-IPO Group)

➢ | We are a growing company with a limited operating history. If we fail to achieve further marketplace acceptance for our products and services, our business, financial condition and results of operations will be adversely affected. |

➢ | Our Edtech platform is technologically complex, and potential defects in our platforms or in updates to our platforms could be difficult or even impossible to fix. |

➢ | System disruptions, capacity constraints and vulnerability from security risks to our online computer networks could impact our ability to generate revenues and damage our reputation, limiting our ability to attract and retain students. |

➢ | Our current success and future growth depend on the continued acceptance of the Internet and the corresponding growth in users seeking educational services on the Internet. |

➢ | We are susceptible to the illegal or improper use of our content, Edtech and platform (whether from students, teachers, Mentors, management personnel and other employees, or third parties), or other forms of misconduct, which could expose us to liability and damage our business and brand. |

➢ | We may be unable to manage and adapt to changes in technology. |

➢ | We must monitor and protect our Internet domain names to preserve their value. |

➢ | The long-term success of our campuses is highly dependent on our ability to effectively identify and secure appropriate sites for new resorts and cafes. |

➢ | Increases in labor costs, labor shortages, and any difficulties in attracting, motivating, and retaining well- qualified employees within the hospitality industry could have an adverse effect on our business, financial condition, and results of operations for our resorts and cafes. |

Risks Related to Our Business and Industry (Specific to IPO Acquisitions)

➢ | If we default on a payment on the note payable that is part of the purchase consideration for UAV, the ownership and control of UAV will revert to the sellers. |

➢ | We are pursuing the IPO Acquisitions and may pursue other strategic acquisitions or investments. The failure of an acquisition or investment (including but not limited to the IPO Acquisitions) to be completed or to produce the anticipated results, or the inability to fully integrate an acquired company, could harm our business. |

➢ | The continued success of our IPO Acquisitions depends initially on the value of the local brands of each of the companies and how we integrate those brands with Genius Group and GeniusU, which may be materially adversely affected by changes in current and prospective students’ perceptions post-acquisition. |

➢ | Growing the certified education courses offered by our IPO Acquisitions could be difficult for us. |

3

➢ | Our IPO Acquisitions are subject to uncertain and varying laws and regulations, and any changes to these laws or regulations may materially adversely affect our business, financial condition and results of operations. |

➢ | Regulatory changes that affect the timing of government-sponsored student aid payments or receipt of government-sponsored financial aid could materially adversely affect our liquidity. |

➢ | The changing public perception and changes to government policies with respect to private schools may have a materially adverse impact on our IPO Acquisitions and our overall plans to expand in the early learning, primary school, secondary school and university markets. |

➢ | The poor performance or reputation of other early learning schools or the industry as a whole could tarnish the reputation of our IPO Acquisition, Education Angels, which could have a negative impact on its business. |

➢ | Changes in the demand for childcare and workplace solutions, which may be negatively affected by demographic trends and economic conditions, including unemployment rates, may affect Education Angels. |

➢ | The expansion of Education Angels, into certain markets including the United States may be negatively impacted by increased competition based on changes in government regulation and benefit programs. |

➢ | Our IPO Acquisition, E-Square, may be negatively affected by the economic and political conditions in South Africa. |

➢ | Public perception and regulatory changes in the primary school and secondary school systems in countries that E-Square may expand to may have a materially adverse impact on the company. |

➢ | Our growth plans for E-Square and our plans to expand into the primary school and high school markets will be a complex and lengthy process where future success is not assured. |

➢ | If we cannot maintain student enrollments and maintain tuition levels in our IPO Acquisition, UAV, the university’s results of operations may be materially adversely affected. |

➢ | The reputation of UAV may be negatively influenced by the actions of other for-profit and private universities. |

➢ | The university and vocational college market is very competitive, and we may not be able to achieve our growth plans with UAV. |

➢ | If the graduates of UAV are unable to obtain professional licenses or certifications required for employment in their chosen fields of study, the university’s reputation may suffer and we may face declining enrollments and revenues or be subject to student litigation. |

➢ | If the graduates of UAV to not meet possible future standards of “gainful employment,” this may negatively affect the university’s reputation and access to government funding. |

➢ | Growing the online academic programs of UAV on the GeniusU Edtech platform could be difficult for us. |

➢ | If for-profit universities and colleges, which offer online education alternatives different from ours, perform poorly, it could tarnish the reputation of online education as a whole, which could impair UAV’s ability to grow its business. |

➢ | Our growth plans for UAV and our plans to expand into the university and vocational college market in the United States and globally is a complex and lengthy process, exposing us to risks inherent in international growth. |

➢ | The course content of our IPO Acquisition, PIN, requires ongoing updating based on the current government regulations and market conditions of the property market. |

➢ | The wide range of differences between the property markets in different countries may make it challenging for PIN to achieve its global expansion plan. |

➢ | The reputation of PIN may be negatively influenced by the actions of other property investing training companies and courses. |

Risks Related to Investing in a Foreign Private Issuer or a Singapore Company

➢ | As a foreign private issuer, we are permitted to follow certain home country corporate governance practices in lieu of certain requirements under the NYSE American listing standards. This may afford less protection to holders of our ordinary shares than U.S. regulations. |

➢ | We are a foreign private issuer and, as a result, we are not subject to U.S. proxy rules and are instead subject to the Securities Exchange Act of 1934, as amended (the “Exchange Act”) reporting obligations that, to some extent, are more lenient and less detailed than those for a U.S. issuer. |

4

➢ | We may lose our foreign private issuer status, which would then require us to comply with the Exchange Act’s domestic reporting regime and cause us to incur additional legal, accounting and other expenses. |

➢ | We are a Singapore incorporated company, and it may be difficult to enforce a judgment of U.S. courts for civil liabilities under U.S. federal securities laws against us, our directors or officers in Singapore. |

➢ | We are incorporated in Singapore, and our shareholders may have more difficulty in protecting their interests than they would as shareholders of a corporation incorporated in the United States. |

➢ | We are subject to the laws of Singapore, which differ in certain material respects from the laws of the United States. |

➢ | Singapore take-over laws contain provisions that may vary from those in other jurisdictions. |

➢ | Subject to the general authority to allot and issue new ordinary shares provided by our shareholders, the Singapore Companies Act and our constitution, our directors may allot and issue new ordinary shares on terms and conditions and for such purposes as may be determined by our Board of Directors (“Board”) in its sole discretion. |

➢ | We may be or become a passive foreign investment company, which could result in adverse U.S. federal income tax consequences to U.S. Holders. |

➢ | Singapore taxes may differ from the tax laws of other jurisdictions. |

➢ | Tax authorities could challenge the allocation of income and deductions among our subsidiaries, which could increase our overall tax liability. |

Risks Related to Ownership of Ordinary Shares

➢ | In the future, our ability to raise additional capital to expand our operations and invest in our business may be limited, and our failure to raise additional capital, if required, could impair our business. |

➢ | Our share price may be volatile, and the market price of our ordinary shares may drop. |

➢ | We have broad discretion over the use of proceeds we received in our IPO and may not apply the proceeds in ways that increase the value of our ordinary shares. |

➢ | A significant portion of our total outstanding shares may be sold into the public market in the near future, which could cause the market price of our ordinary shares to drop significantly, even if our business is doing well. |

➢ | If securities or industry analysts do not publish or cease publishing research or reports about us, our business, or our market, or if they change their recommendations regarding our ordinary shares adversely, our share price and/or trading volume could decline. |

➢ | We may not pay dividends on our ordinary shares in the future and, consequently, the investors’ ability to achieve a return on their investment will depend on appreciation in the price of our ordinary shares. |

➢ | We currently report our financial results under IFRS, which differs in certain significant respects from U.S. GAAP. |

➢ | We are an emerging growth company within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and if we take advantage of certain exemptions from disclosure requirements available to emerging growth companies, this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies. |

➢ | We incur significantly increased costs and devote substantial management time as a result of operating as a public company. |

➢ | If we fail to maintain an effective system of internal control over financial reporting in the future, we may not be able to accurately report our financial condition, results of operations or cash flows, which may adversely affect investor confidence. |

➢ | If we are not able to comply with the applicable continued listing requirements or standards of the NYSE American, the NYSE American could delist our ordinary shares. |

5

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A.Selected financial data

The following tables set forth summary combined pro forma financial data and audited summary consolidated financial data for the periods and as of the dates indicated. The summary combined unaudited pro forma financial data below includes the consolidated financials of all companies in the Genius Group, including the Pre-IPO Group and the IPO Acquisitions as if they were operating as one group in the periods indicated. The pro forma financials for 2021 include the audited financial data of the Pre-IPO Group together with the audited financial data of University of Antelope Valley and Property Investors Network, which are both deemed significant acquisitions, and the unaudited financial data of Education Angels and E-Square, which are below the threshold of significant acquisitions. Following the IPO on 14 April 2022, the acquisitions of Education Angels and Property Investors Network have closed and the acquisition of E-Square and University of Antelope Valley are pending.

The summary income data for the years ended December 31, 2020 and 2021 and the summary balance sheet data as of December 31, 2020 and 2021 for the Pre-IPO Group are derived from the audited consolidated financial statements included in this Annual Report. Our audited consolidated financial statements have been prepared in U.S. dollars and in accordance with IFRS, as issued by the IASB.

6

Genius Group is made up of eight companies (taking into account the IPO Acquisitions) that have varying financial performance. For this reason, you should read the summary combined pro forma financial data in conjunction with our audited consolidated financial statements and related notes beginning on page F-1 of this Annual Report, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this Annual Report. Our historical results do not necessarily indicate our expected results for any future periods.

Genius Group |

| Pre-IPO Group | ||||

Pro forma | Audited Financials | |||||

Year Ended | Year Ended | |||||

December 31, | December 31, | |||||

2021 | 2021 | 2020 | ||||

| (USD 000’s) |

| (USD 000’s) | (USD 000’s) | ||

Sales | 28,569 | 12,778 |

| 7,634 | ||

Cost of goods sold | (15,886) | (10,021) | (4,134) | |||

Gross profit (Loss) | 12,683 | 2,757 | 3,500 | |||

Other Operating Income | 343 | 324 | 11 | |||

Operating Expenses |

| (17,292) |

| (7,250) |

| (6,192) |

Operating profit (Loss) |

| (4,266) |

| (4,169) |

| (2,681) |

Other income |

| 1,143 |

| — |

| 412 |

Other Expense |

| (1,350) |

| (449) |

| (854) |

Net Income (Loss) Before Tax |

| (4,473) |

| (4,618) |

| (3,123) |

Tax Expense |

| (186) |

| 129 |

| (69) |

Net Income (Loss) After Tax |

| (4,659) |

| (4,489) |

| (3,192) |

Other Comprehensive Income |

| 230 |

| 230 |

| 2,129 |

Total Income (Loss) |

| (4,429) |

| (4,259) |

| (1,063) |

Net income per share, basic and diluted |

| (0.25) |

| (0.28) |

| (0.25) |

Weighted-average number of shares outstanding, basic and diluted |

| 18,347,602 |

| 16,155,810 |

| 12,575,605 |

Genius Group |

| Pre-IPO Group | ||||

Pro forma | Audited Financials | |||||

Year Ended | Year Ended | |||||

December 31, | December 31, | |||||

2021 | 2021 | 2020 | ||||

| (USD 000’s) |

| (USD 000’s) |

| (USD 000’s) | |

Summary Balance Sheet Data: |

|

|

| |||

Total current assets | 30,663 | 6,496 | 4,937 | |||

Total non-current assets | 52,014 | 11,099 | 12,021 | |||

Total Assets | 82,677 | 17,595 | 16,958 | |||

Total current liabilities |

| 19,355 |

| 7,140 |

| 5,379 |

Total non-current liabilities |

| 23,720 |

| 2,469 |

| 3,873 |

Total Liabilities |

| 43,076 |

| 9,609 |

| 9,252 |

Total Shareholders’ Equity |

| 39,601 |

| 7,986 |

| 7,706 |

Total Liabilities and Shareholders’ Equity |

| 82,677 |

| 17,595 |

| 16,958 |

Non-IFRS Financial Measures — Adjusted EBITDA

We have included Adjusted EBITDA in this Annual Report because it is a key measure used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. In particular, the exclusion of certain expenses in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business. Non-IFRS financial measures are not a substitute for IFRS financial measures.

7

We calculate Adjusted EBITDA as Net loss for the period plus income taxes and social contribution plus/ minus net finance result plus depreciation and amortization plus/minus share-based compensation expenses plus bad debt provision. Share-based compensation expenses and bad debt provision are included in General and administrative expenses in the Consolidated Statements of Operations.

Genius Group |

| Pre-IPO Group | ||||

Pro forma | Audited Financials | |||||

Year Ended | Year Ended | |||||

December 31, | December 31, | |||||

2021 | 2021 | 2020 | ||||

| (USD 000’s) |

| (USD 000’s) |

| (USD 000’s) | |

Net Income (Loss) | (4,659) | (4,489) | (3,192) | |||

Tax Expense | 186 | (129) | 69 | |||

Interest Expense, net | 1,342 | 450 | 854 | |||

Depreciation and Amortization | 2,120 | 1,575 | 1,571 | |||

Goodwill Impairments |

| — |

| — |

| — |

Stock Based Compensation |

| 294 |

| 294 |

| 399 |

Bad Debt Provision |

| 969 |

| (39) |

| 162 |

Adjusted EBITDA |

| 252 |

| (2,338) |

| (137) |

Key Business Metrics

Education segment — Genius Group (including IPO Acquisitions)

Year ended December 31, 2021

| University |

|

|

|

|

| |||||||

of | Property | ||||||||||||

Antelope | Investors | Education | |||||||||||

| GeniusU |

| Valley |

| Network |

| Angels |

| E-Square |

| Total | ||

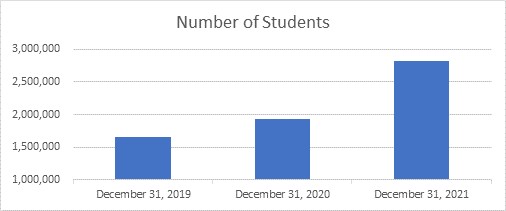

Number of students | 2,663,745 | 3,102 | 157,599 | 732 | 450 | 2,825,628 |

| ||||||

Number of Free Students | 2,626,384 | — | 142,131 | — | 15 | 2,768,530 |

| ||||||

Number of Paying Students | 37,361 | 3,102 | 30,792 | 732 | 435 | 72,422 |

| ||||||

Number of Partners |

| 10,217 |

| 238 |

| 604 |

| 312 |

| 43 |

| 11,414 | |

Number of countries of operation |

| 191 |

| 1 |

| 52 |

| 1 |

| 1 |

| 191 | |

Marketing Spend |

| 873,628 |

| 110,036 |

| 118,756 |

| 6,074 |

| 31,434 |

| 1,139,928 | |

Education Revenue |

| 9,677,513 |

| 9,038,605 |

| 5,091,984 |

| 942,474 |

| 717,677 |

| 25,468,253 | |

Revenue from New Paying Students |

| 3,446,952 |

| 2,259,651 |

| 2,097,629 |

| 239,102 |

| 377,811 |

| 7,377,236 | |

New Students |

| 863,225 |

| 281 |

| 26,488 |

| 102 |

| 232 |

| 890,328 | |

New Paying Students |

| 3,441 |

| 281 |

| 6,372 |

| 102 |

| 229 |

| 10,425 | |

Conversion rate |

| 0.40 | % | 100.00 | % | 24.06 | % | 100.00 | % | 98.71 | % | 1.17 | % |

Average Acquisition Cost per New Paying Student |

| 253.89 |

| 391.59 |

| 18.64 |

| 59.55 |

| 137.27 |

| 109.35 | |

Average Annual Revenue per New Paying Student |

| 1,001.73 |

| 8,041.46 |

| 329.19 |

| 2,344.14 |

| 1,649.83 |

| 707.65 | |

Net Income (Loss) margin |

| (22.61) | % | (6.90) | % | 31.42 | % | (5.65) | % | 14.51 | % | (4.56) | % |

Adjusted EBITDA margin |

| (15.98) | % | 2.81 | % | 44.72 | % | (5.22) | % | 15.10 | % | 4.10 | % |

8

Year ended December 31, 2020

| University |

|

|

|

|

| |||||||

of | Property | ||||||||||||

Antelope | Investors | Education | |||||||||||

| GeniusU |

| Valley |

| Network |

| Angels |

| E-Square |

| Total | ||

Number of students | 1,800,520 | 2,821 | 131,111 | 630 | 546 | 1,935,628 |

| ||||||

Number of Free Students | 1,766,600 | — | 106,691 | — | — | 1,873,291 |

| ||||||

Number of Paying Students | 33,920 | 2,821 | 24,420 | 630 | 546 | 62,337 |

| ||||||

Number of Partners |

| 9,399 |

| 214 |

| 570 |

| 270 |

| 43 |

| 10,496 | |

Number of countries of operation |

| 191 |

| 1 |

| 52 |

| 1 |

| 1 |

| 191 | |

Marketing Spend |

| 576,028 |

| 175,141 |

| 287,694 |

| 34,708 |

| 78,586 |

| 1,152,157 | |

Education Revenue |

| 5,618,210 |

| 10,078,158 |

| 4,598,750 |

| 1,068,204 |

| 827,675 |

| 22,190,997 | |

Revenue from New Paying Students |

| 1,809,457 |

| 2,418,758 |

| 1,603,998 |

| 534,102 |

| 287,890 |

| 6,654,205 | |

New Students |

| 247,388 |

| 559 |

| 27,353 |

| 210 |

| 270 |

| 275,780 | |

New Paying Students |

| 3,450 |

| 559 |

| 3,277 |

| 210 |

| 270 |

| 7,766 | |

Conversion rate |

| 1.39 | % | NA |

| 11.98 | % | NA |

| NA |

| 2.81 | % |

Average Acquisition Cost per New Paying Student |

| 121.91 |

| 313.31 |

| 148.82 |

| 165.28 |

| 291.06 |

| 154.10 | |

Average Annual Revenue per New Paying Student |

| 524.48 |

| 4,327 |

| 489.47 |

| 2,543 |

| 1,066 |

| 857 | |

Net Income (Loss) margin |

| 1.90 | % | 17.91 | % | 22.89 | % | 19.17 | % | 23.16 | % | 15.14 | % |

Adjusted EBITDA margin |

| 24.38 | % | 21.29 | % | 45.17 | % | 23.36 | % | 28.35 | % | 27.38 | % |

Campus segment – Entrepreneur Resorts

Year Ended December 31, 2021

| Café |

| Central |

| Resort |

| Total |

| |

Revenue |

| 158,877 |

| 1,244,227 |

| 1,697,646 |

| 3,100,750 | |

No of Location |

| 2 |

| 1 |

| 3 |

| 6 | |

No of Seats/Room |

| 141 |

| 177 |

| 49 |

| 367 | |

Utilization |

| 27 | % | 33 | % | 24 | % | 28 | % |

Total Orders |

| 23,122 |

| 69,634 |

| 3,634 |

| 96,390 | |

Revenue Per Order |

| 6.87 |

| 17.87 |

| 467.16 |

| 32.17 |

Year Ended December 31, 2020

| Café |

| Central |

| Resort |

| Total |

| |

Revenue |

| 342,238 |

| 500,629 |

| 1,172,699 |

| 2,015,566 | |

No of Location |

| 2 |

| 1 |

| 3 |

| 6 | |

No of Seats/Room |

| 141 |

| 177 |

| 49 |

| 367 | |

Utilization |

| 20 | % | 24 | % | 26 | % | 24 | % |

Total Orders |

| 37,185 |

| 36,182 |

| 8,538 |

| 81,905 | |

Revenue Per Order |

| 9.2 |

| 13.84 |

| 137.35 |

| 24.61 |

9

B.Capitalization and indebtedness

Not applicable.

C.Reasons for the offer and use of proceeds

Not applicable.

D.Risk Factors

Investing in our ordinary shares is highly speculative and involves a significant degree of risk. You should carefully consider the following risks, as well as other information contained in this Annual Report, before making an investment in our Company. The risks discussed below could materially and adversely affect our business, prospects, financial condition, results of operations, cash flows, ability to pay dividends and the trading price of our ordinary shares. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, prospects, financial condition, results of operations, cash flows and ability to pay dividends, and you may lose all or part of your investment.

Risks Related to Our Business and Industry (All Group Companies)

We are a global business subject to complex economic, legal, political, tax, foreign currency and other risks associated with international operations, which risks may be difficult to adequately address.

In 2019, 2020 and 2021, over 90% of our revenues from the Pre-IPO Group were generated from operations outside of the United States. When including the IPO Acquisitions, over 50% of our pro forma revenues for Genius Group for these same periods were generated from operations outside of the United States. Our GeniusU Edtech platform has students in 200 countries, each of which is subject to complex business, economic, legal, political, tax and foreign currency risks. As we continue to expand our international operations with our IPO Acquisitions, we may have difficulty managing and administering a globally dispersed business and we may need to expend additional funds to, among other things, staff key management positions, obtain additional information technology infrastructure and successfully implement relevant course and program offerings for a significant number of international markets, which may materially adversely affect our business, financial condition and results of operations.

Additional challenges associated with the conduct of our business overseas that may materially adversely affect our operating results include:

➢ | the large scale and diversity of our operational institutions present numerous challenges, including difficulty in staffing and managing foreign operations as a result of distance, language, legal, labor relations and other differences; |

➢ | each of our programs and services are subject to unique business risks and challenges including competitive pressures and diverse pricing environments at the local level; |

➢ | difficulty maintaining quality standards consistent with our brands and with local accreditation requirements; |

➢ | fluctuations in exchange rates, possible currency devaluations and currency controls, inflation and hyperinflation; |

➢ | difficulty selecting and monitoring partners in different jurisdictions; |

➢ | compliance with a wide variety of domestic and foreign laws and regulations; |

➢ | expropriation of assets by governments; |

➢ | political elections and changes in government policies; |

➢ | changes in tax laws, assessments or enforcement by taxing authorities in different jurisdictions; |

➢ | difficulty protecting our intellectual property rights overseas due to, among other reasons, the uncertainty of laws and enforcement in certain countries relating to the protection of intellectual property rights; |

➢ | lower levels of availability or use of the Internet, through which our online programs are delivered; |

10

➢ | limitations on the repatriation and investment of funds, foreign currency exchange restrictions and inability to transfer cash back to the United States without taxation; |

➢ | potential economic and political instability the countries in which we operate, including student unrest; or |

➢ | business interruptions from acts of terrorism, civil disorder, labor stoppages, public health risks, crime and natural disasters, particularly in areas in which we have significant operations. |

Our success in growing our business profitably will depend, in part, on the ability to anticipate and effectively manage these and other risks related to operating in various countries. Any failure by us to effectively manage the challenges associated with the maintenance or expansion of our international operations could materially adversely affect our business, financial condition and results of operations.

Our growth strategy anticipates that we will create new products, services, and distribution channels and expand existing distribution channels. If we are unable to effectively manage these initiatives, our business, financial condition, results of operations and cash flows would be adversely affected.

As we create new products, services, and distribution channels and expand our existing distribution channels, we expect to face challenges distinct from those we currently encounter, including:

➢ | The challenge of tailoring new products and services to new technologies as they develop, including artificial intelligence, augmented reality and virtual reality; |

➢ | Additional local competition as we localize our products and services to different countries, cultures and languages, each with new, local distribution channels; |

➢ | Changing student habits as new distribution channels for learning content are developed globally; and |

➢ | Unpredictable market behavior as the education market develops new distribution channels for learning outside the traditional school system, including via online courses and virtual learning. |

Our failure to manage these new distribution channels, or any new distribution channels we pursue, may have an adverse effect on our business, financial condition, results of operations and cash flows.

Our growth may have a negative effect on the successful expansion of our business, on our people management, and on the increase in complexity of our software and platforms.

We are currently experiencing a period of significant expansion and are facing a number of expansion related issues, such as the acquisition and retention of experienced and talented personnel, cash flow management, corporate culture and internal controls, among others. These issues and the significant amount of time spent on addressing them may result in the diversion of our management’s attention from other business issues and opportunities.

We anticipate that these expansion related issues will increase with our IPO Acquisitions and future growth. In addition, we believe that our corporate culture and values are critical to our success, and we have invested a significant amount of time and resources building them. If we fail to preserve our corporate culture and values, our ability to recruit, retain and develop personnel and to effectively implement our strategic plans may be harmed.

We must constantly update our software and platforms, enhance and improve our billing and transaction and other business systems, and add and train new software designers and engineers, as well as other personnel to help us with the increased use of our platforms and the new solutions and features we regularly introduce.

This process is time intensive and expensive and may lead to higher costs in the future. Furthermore, we may need to enter into relationships with various strategic partners, such as online service providers and other third parties necessary to our business. The increased complexity of managing multiple commercial relationships could lead to execution problems that can affect current and future revenue, and operating margins.

11

We cannot assure you that our current and planned platforms, systems, products, procedures and controls, personnel and third-party relationships will be adequate to support our future operations. In addition, our current expansion has placed a significant strain on management and on our operational and financial resources, and this strain is expected to continue. Our failure to manage growth effectively could harm our business, results of operations and financial condition.

If our growth rate decelerates significantly, our prospects and financial results would be adversely affected, preventing us from achieving profitability.

We believe that our growth depends on a number of factors, including, but not limited to, our ability to:

➢ | Integrate the IPO Acquisitions into the Group; |

➢ | Continue to introduce our products and services to new markets; |

➢ | Provide high-quality support to students and partnerships using our products and services; |

➢ | Expand our business and increase our market share; |

➢ | Compete with the products, services, offers, prices and incentives offered by our competitors; |

➢ | Develop new products, services, offerings and technologies; |

➢ | Identify and acquire or invest in businesses, products, offerings or technologies that we believe may be able to complement or expand our platform; and |

➢ | Increase the positive perception of our brands. |

We may not be successful in achieving the above objectives. Any slowdown in the demand from students, teachers, Mentors, and partnerships for our products and services caused by changes in customer preferences, failure to maintain our brands, inability to expand our portfolio of products or services, changes in the global economy, taxes, competition or other factors may lead to a decrease in revenue or growth and our financial results and future prospects could be negatively affected. We expect that we will continue to incur significant expenses as a result of our efforts to continue growing, and if we cannot increase our revenue at a faster rate than the increase in our expenses, we will not be able to achieve profitability.

We may be unable to recruit, train and/or retain qualified teachers, Mentors, and other skilled professionals.

Effective teachers and Mentors are critical to maintaining the quality of our learning system and curriculum and assisting students with their lessons. The educational content and materials we provide are a combination of content developed in-house, by our teachers, and our Mentors. Teachers and Mentors must have strong interpersonal communications skills to be able to effectively instruct students, especially in virtual settings. They must also possess the technical skills to use our technology-based learning systems and be willing to publish their content on our platform.

Our requirement for teachers at all levels will increase once all the IPO Acquisitions are completed. There is a limited pool of qualified individuals with these specialized attributes. We must also provide continuous training to teachers and Mentors so that they can stay abreast of changes in student demands, academic standards and other key trends necessary to teach online effectively. We may not be able to recruit, train and retain enough qualified teachers and Mentors to keep pace with our growth while maintaining consistent teaching quality and robust platform content.

Shortages of qualified teachers or Mentors, or decreases in the quality of our instruction or the amount and quality of educational content we can produce and offer as a result, whether actual or perceived, would have an adverse effect on our business.

Our success also depends in large part on our senior management and key personnel as well as in general upon highly trained finance, technical, recruiting and marketing professionals in order to operate our business, increase revenues from our existing products and services and to launch new product offerings. If any of these employees leave us and we fail to effectively manage a transition to new personnel, or if there is a shortage in the number of people with the requisite skills or we fail to attract and retain qualified and experienced professionals on acceptable terms, our business, financial conditions and results of operations could be adversely affected.

12

Our business may be materially adversely affected if we are not able to maintain or improve the content of our existing courses or to develop new courses on a timely basis and in a cost-effective manner.

We continually seek to maintain and improve the content of our existing courses and develop new courses in order to meet changing market needs. Revisions to our existing courses and the development of new courses may not be accepted by existing or prospective students in all instances. If we cannot respond effectively to market changes, our business may be materially adversely affected. Even if we are able to develop acceptable new courses, we may not be able to introduce these new courses as quickly as students require or as quickly as our competitors are able to introduce competing courses. If we do not respond adequately to changes in market requirements, our ability to attract and retain students could be impaired and our financial results could suffer. This applies to all of our Pre-IPO Group companies and IPO Acquisitions.

Establishing new courses or modifying existing courses also may require us to make investments in specialized personnel and capital expenditures, increase marketing efforts and reallocate resources away from other uses. We may have limited experience with the subject matter of new courses and may need to modify our systems and strategy. If we are unable to increase the number of students, offer new courses in a cost-effective manner or otherwise manage effectively the operations of newly established courses, our business, financial condition and results of operations could be materially adversely affected.

Failure to attract and retain students to enroll in our courses and programs, and to maintain tuition levels, may have a material adverse impact on our business and prospects

The success of our business depends primarily on the number of student enrollments in the courses and programs we offer on our platform microschools, and events, and the amount of our course and program fees. As a result, our ability to attract students to enroll in our courses and programs is critical to the continued success and growth of our business. This, in turn, will depend on several factors, including, among others, our ability to develop new educational programs and enhance existing educational programs to respond to the changes in market trends, student demands and government policies, to maintain our consistent and high teaching quality, to market our programs successfully to a broader prospective student base, to develop additional high-quality educational content, sites and availability of our platform and to respond effectively to competitive market pressures.

If our students or their parents perceive that our education quality deteriorated due to unsatisfying learning experiences, which may be subject to a number of subjective judgments that we have limited influence over, our overall market reputation may diminish, which in turn may affect our word-of-mouth referrals and ultimately our student enrollment. In addition, the expansion of our offering of courses and services may not succeed due to competition, our failure to effectively market our new courses and services (whether due to defects in our marketing tools and/or failure to adjust our strategy in order to meet the needs of current and potential customers), maintain the quality of our courses and services, or other factors. We may be unable to develop and offer additional educational content on commercially reasonable terms and in a timely manner, or at all, to keep pace with changes in market trends and student demands. If we are unable to control the rate of student attrition, which can be affected by various factors outside our control such as students’ personal circumstances and local socioeconomic factors, our overall enrollment levels are likely to decline or if we are unable to charge tuition rates that are both competitive and cover our rising expenses, our business, financial condition, cash flows and results of operations may be materially adversely affected.

If student performance falls or parent and student satisfaction declines, a significant number of students may not remain enrolled in our programs, and our business, financial condition and results of operations will be adversely affected.

The success of our business depends on a family’s decision to have their child continue his or her education through our programs. This decision is based on many factors, including student achievement and parent and student satisfaction. We expect that, as our enrollments increase and the portion of students that have not used our learning system for multiple years increases, the average performance of all students using our learning system may decrease, even if the individual performance of other students improves over time. Additionally, parent and student satisfaction may decline as not all parents and students are able to devote the substantial time and energy necessary to complete our curriculum. A student’s satisfaction may also suffer if his or her relationship with the virtual school teacher does not meet expectations. If a student’s performance or satisfaction declines, students may decide not to remain enrolled in one or more of our programs, financial condition and results of operations will be adversely affected.

13

Our curriculum and approach to instruction may not achieve widespread acceptance, which would limit our growth and profitability.

Our curriculum and approach to instruction are based on students learning how to “create a job” rather than “get a job.” The goal of this approach is to make students entrepreneurs. This approach, however, is not accepted by all students, academics and educators, who may favor more traditional and formalistic methods, along with more traditional course offerings and curriculums. Accordingly, some students, academics and educators are opposed to the principles and methodologies associated with our approach to learning and have the ability to negatively influence the market for our products and services.

The continued development of our brand identity is important to our business. If we are not able to maintain and enhance our brand, our business and operating results may suffer.

Expanding brand awareness is critical to attracting and retaining students, teachers, and Mentors, and for serving additional jurisdictions. We believe that the quality of our curriculum and management services has contributed significantly to the success of our brand. As we continue to increase enrollments and extend our geographic reach, maintaining quality and consistency across all of our services and products may become more difficult to achieve, and any significant and well-publicized failure to maintain this quality and consistency will have a detrimental effect on our brand. We cannot provide assurances that our new sales and marketing efforts will be successful in further promoting our brand in a competitive and cost-effective manner. If we are unable to further enhance our brand recognition and increase awareness of our products and services, or if we incur excessive sales and marketing expenses, our business and results of operations could be adversely affected.

Each of our companies has worked hard to establish the value of its individual brand. Brand value may be severely damaged, even by isolated incidents, particularly if the incidents receive considerable negative publicity. There has been a marked increase in use of social media platforms, including weblogs (blogs), social media websites, and other forms of Internet-based communications that allow individuals access to a broad audience of interested persons. We believe students and prospective teachers and Mentors value readily available information about our companies and programs and often act on such information without further investigation or authentication, and without regard to its accuracy. Social media platforms and devices immediately publish the content their subscribers and participants post, often without filters or checks on the accuracy of the content posted. Information concerning our Company and our programs may be posted on such platforms and devices at any time. Information posted may be materially adverse to our interests, it may be inaccurate, and it may harm our performance and prospects.

The risk of damage or dilution of brand identity potentially increases during acquisitions, and this risk may increase once we have completed the IPO Acquisitions and may increase during the post-acquisition process of integration and expansion.

If our partnerships are unable to maintain educational quality, we may be adversely affected.

Our partnerships with institutions, such as universities, and other educational providers and their students are regularly assessed and classified under the terms of applicable educational laws and regulations. If the partnerships or students receive lower scores from year to year on any of their assessments, or if there is any drop in the acceptance rates of students into prestigious universities, we may be negatively affected by perceptions of a decline in the educational quality of our content and Edtech platform, which could adversely affect our reputation and, as a result, our operating results and financial condition.

14

There is significant competition in the market segments that we serve, and we expect such competition to increase; we may not be able to compete effectively.

Education markets around the world are competitive and dynamic. We face varying degrees of competition from several discrete education providers because our learning system integrates many of the elements of the education development and delivery process, including curriculum development, teacher training and support, lesson planning, testing and assessment, and school performance and compliance management. We compete most directly with companies that provide online curriculum and support services. Additionally, we expect increased competition from for-profit post-secondary and supplementary education providers that have begun to offer virtual high school curriculum and services. In certain jurisdictions and states where we currently serve virtual public schools, we expect intense competition from existing providers and new entrants. Our competitors may adopt similar curriculum delivery, school support and marketing approaches, with different pricing and service packages that may have greater appeal in the market. Both public and private not-for-profit institutions with whom we currently or may in the future compete may have instructional and support resources superior to those in the for-profit sector, and public institutions can offer substantially lower tuition prices or other advantages that we cannot match. If we are unable to successfully compete for new business, acquire more companies, or maintain current levels of academic achievement and community interest, our revenue growth and operating margins may decline. Price competition from our current and future competitors could also result in reduced revenues, reduced margins or the failure of our product and service offerings to achieve or maintain more widespread market acceptance.

We may also face direct competition from publishers of traditional educational materials that are substantially larger than we are and have significantly greater financial, technical and marketing resources. As a result, they may be able to devote more resources to develop products and services that are superior to our platform and technologies. We may not have the resources necessary to acquire or compete with technologies being developed by our competitors, which may render our online delivery format less competitive or obsolete.

Our future success will depend in large part on our ability to maintain a competitive position with our curriculum and our technology, as well as our ability to increase capital expenditures to sustain the competitive position of our product. We cannot assure you that we will have the financial resources, technical expertise, marketing, distribution or support capabilities to compete effectively.

The COVID-19 pandemic has significantly negatively impacted segments of our business and may continue to do so.

The COVID-19 pandemic has disrupted the global economy and has negatively impacted large populations including people and businesses, some of which have been and are being directly or indirectly involved with the operation of our Company, products, and services. The economic impact of COVID-19 is still ongoing and there are many risks from COVID-19 that are negatively impacting economies and healthcare providers in the countries where we do business, and the education industry as a whole. At this time, we have identified the following COVID-19 related risks that have negatively affected our Company’s operations and financial results and may continue to do so:

➢ | Local government-imposed restrictions negatively impact the ability of our resorts, cafes and locations to operate; |

➢ | International travel restrictions affect our ability to attract international students to our retreats and events, and to attract our faculty members to our certification programs; |

➢ | Government-imposed restrictions also negatively impact some of our IPO Acquisition companies from keeping their schools, colleges or university open, and to operate physical summer camps; |

➢ | Health concerns affect the willingness or ability of some of our students and faculty to attend physical events; and |

➢ | The economic impact of the pandemic affects the ability of some of our students and teachers to purchase and pay for our courses, products and services. |

Please refer to the “Business Impact of the COVID-19 Pandemic” section elsewhere in this Annual Report for specific details of the impact of the COVID-19 pandemic on our Company to date, both negative and positive, together with what we expect the pandemic’s future impact to be, and how we have responded and continue to respond to COVID-19 related uncertainties.

15

Our business and operations may be adversely affected by economic uncertainty and volatility in the financial markets, including as a result of the military conflict in Ukraine.

Our business and results of operations may be adversely affected by various factors that could cause economic uncertainty and volatility in the financial markets, many of which are beyond our control. Our business could be impacted by, among other things, downturns in the financial markets or in economic conditions, increases in oil prices, inflation, increases in interest rates, supply chain disruptions, declines in consumer confidence and spending, and geopolitical instability, such as the military conflict in the Ukraine. We cannot at this time fully predict the likelihood of one or more of the above events, their duration or magnitude or the extent to which they may negatively impact our business.

Our business may be materially adversely affected by a general economic slowdown or recession.

Many countries around the world have recently experienced reduced economic activity, increased unemployment, and substantial uncertainty about their financial services markets and, in some cases, economic recession. These events may reduce the demand for our programs among students, which could materially adversely affect our business, financial condition, results of operations and cash flows. These adverse economic developments also may result in a reduction in the number of jobs available to our graduates and lower salaries being offered in connection with available employment which, in turn, may result in declines in our placement and retention rates. Any general economic slowdown or recession that disproportionately impacts the countries in which our companies and programs operate could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We may be sued for infringement of the intellectual property rights of others, and such actions would be costly to defend, could require us to pay damages and could limit our ability or increase our costs to use certain technologies in the future.

Companies in the Internet, technology, education, curriculum and media industries own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. As we grow, the likelihood that we may be subject to such claims also increases. Regardless of the merits, intellectual property claims are often time- consuming and expensive to litigate or settle. In addition, to the extent claims against us are successful, we may have to pay substantial monetary damages or discontinue any of our products, services or practices that are found to be in violation of another party’s rights. We also may have to seek a license and make royalty payments to continue offering our products and services or following such practices, which may significantly increase our operating expenses.

We cannot assure you that we will not be subject to liability claims for any inaccurate or inappropriate content in our training programs, which could cause us to incur legal costs and damage our reputation.

We develop the content for our training programs ourselves or through partnerships with third parties. We cannot assure you that there will be no inaccurate or inappropriate materials included in our training programs or the materials we obtain from our third-party partners. In addition, our mock examination questions designed internally based on our understanding of the relevant examination requirements may be investigated by the regulatory authorities. Therefore, we may face civil, administrative or criminal liability if an individual or corporate, governmental or other entity believes that the content of any of our training programs violate any laws, regulations or governmental policies or infringes upon its legal rights. Even if such claim were not successful, defending it may cause us to incur substantial costs including the time and attention of our management. Moreover, any accusation of inaccurate or inappropriate content could lead to significant negative publicity, which could harm our reputation and future business prospects.

We may be subject to legal liability resulting from the actions of third parties, including independent contractors and teachers, which could cause us to incur substantial costs and damage our reputation.

We may be subject, directly or indirectly, to legal claims associated with the actions of our independent contractors, teachers, and Mentors. In the event of accidents or injuries or other harm to students, we could face claims alleging that we were negligent, provided inadequate supervision or were otherwise liable for their injuries. Additionally, we could face claims alleging that our independent curriculum contractors or teachers infringed the intellectual property rights of third parties. A liability claim against us or any of our independent contractors, teachers, or Mentors could adversely affect our reputation, enrollment and revenues. Even if unsuccessful, such a claim could create unfavorable publicity, cause us to incur substantial expenses and divert the time and attention of management.

16

We may not have sufficient insurance to protect ourselves against substantial losses.

We have insurance policies to provide coverage against certain potential risks, such as property damage and personal injury, as well as director and officer insurance for our management team. However, we cannot guarantee that our insurance coverage will always be available or will be sufficient to cover possible claims for these risks. In addition, there are certain types of risk that might not be covered by our policies, such as war, acts of nature, force majeure or interruption of certain activities. Moreover, we might be obliged to pay fines and other penalties in the event of delays in product delivery, and such penalties are not covered by our insurance policies. Additionally, we may not be able to renew our current insurance policies under the same terms or at all. Risks not covered by our insurance policies or the inability to renew policies on favorable terms or at all could adversely affect our business and financial condition.

Risks Related to Our Business and Industry (Specific to Pre-IPO Group)

We are a growing company with a limited operating history, and a history of operational losses. If we fail to achieve further marketplace acceptance for our products and services, our business, financial condition and results of operations will be adversely affected.