Exhibit 99.1

Disclosure

We have dual listed our common stock (“common stock”) on the Upstream stock exchange operated by MERJ Exchange (“Upstream”) that is an exchange registered in the Seychelles under the Seychelles Securities Act, 2007. Our shares that are listed and traded on Upstream are uncertificated common stock represented by digital tokens, which represent the same class and shares that are currently traded on NYSE.

Upstream is operated as a fully regulated and licensed integrated securities exchange, clearing system and depository for digital and non-digital securities. Upstream also states that MERJ is an affiliate of the World Federation of Exchanges (WFE), recognized by HM Revenue and Customs UK, a full member of the Association of National Numbering Agencies (ANNA), a Qualifying Foreign Exchange for OTC Markets in the US, and a member of the Sustainable Stock Exchanges Initiative. MERJ is regulated in the Seychelles by the Financial Services Authority Seychelles, https://fsaseychelles.sc/.

All shares of our common stock have been registered with the Commission and make up the entire number of shares issued and outstanding and have the same CUSIP/ISIN number. There are no differences in shareholder rights such as transferability. Shareholders may elect to hold their shares in depositories: Book Entry with TA, CEDE & Co or MERJ Dep.

Digital securities on Upstream are interchangeable on terms that have the same meaning. The digital securities (or tokenized equities) are a digital representation of the company’s common stock that have been issued and registered with the Commission. A digital security is a 1:1 representation of a company’s common stock that acts as a receipt for the deposit or purchase and ownership of shares in the company. The digital recording of ownership is handled in the same manner as a database of shares issued to shareholders and, on Upstream, certifies registered ownership of company shares from a particular date. The ownership details of a tokenized equity balance of the company’s shares for an Upstream shareholder shall include but not be limited to:

| ● | Certificate number | |

| ● | Company name and CUSIP/ISIN number | |

| ● | Shareholder name and address | |

| ● | Number of shares owned | |

| ● | Class of shares | |

| ● | Issue date of shares | |

| ● | Amount paid for the shares the Upstream secondary market |

Our common shares that deposited to Upstream are held by MERJ Dep., which is a licensed Securities Facility, in exchange for the issuance of the digital securities representing those shares that are tradable on Upstream. The beneficial owners of shares of common stock held by the Upstream nominee would be entitled to vote their shares held by the nominee at stockholder meetings and to receive notices and solicitation materials for stockholder meetings, receive the same dividends and all other rights conferred by our Company under state and federal laws. They are afforded these rights since they have not surrendered or otherwise disposed of their US common stock and the applicable laws are the same and the shares are the same class of stock, they are just represented digitally on a smartphone app.

In addition, shareholders on Upstream have the right to receive confirmations, proxy statements and other documents as distributed by the issuer pursuant to their legal obligations. There are no restrictions, limitations, or other losses of rights when US common stock is deposited for secondary trading on Upstream.

Investors are encouraged to take note that as in all dual listed securities that are traded on multiple marketplaces, there can be differences in pricing as a result of different liquidity, price discovery and otherwise. Trading on foreign exchanges can expose investors to various risks, including currency fluctuations and differences in trading rules and regulations. Here are some of the most common risks associated with trading on foreign exchanges like Upstream:

1. Regulatory Risk: Different countries have different rules and regulations governing securities trading, and investors who trade on foreign exchanges may be subject to unfamiliar or complex regulations. In some cases, foreign regulators may have different reporting requirements or different standards for disclosure than US regulators, which can make it difficult for investors to make informed decisions.

2. Market Risk: Foreign markets may be subject to different economic, political, or social conditions than US markets, which can affect the performance of securities traded on those markets. Investors who trade on foreign exchanges may be exposed to higher levels of volatility and uncertainty than they would be if they traded solely on US exchanges.

3. Liquidity Risk: Securities traded on foreign exchanges may have lower liquidity than comparable securities traded on US exchanges, which can make it more difficult for investors to buy or sell those securities at the desired price.

4. Operational Risk: Trading on foreign exchanges may also expose investors to operational risks, such as delays or errors in the settlement of trades or difficulties in accessing trading platforms.

Investors who are considering trading on foreign exchanges including Upstream should carefully evaluate these and other risks and consult with financial and legal advisors before making any investment decisions. They should also be aware of any fees, taxes, or other costs associated with trading on foreign exchanges.

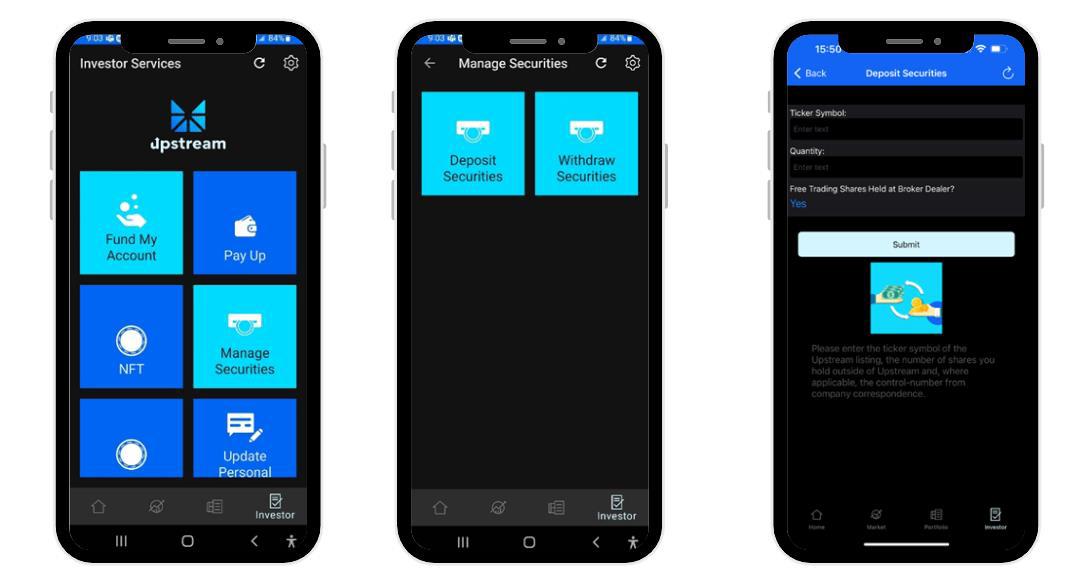

Upstream is accessible from preferred app store at https://upstream.exchange/, creating an account by tapping sign up, and completing a simple KYC identity verification by tapping the settings icon on the home screen and tapping KYC. Interested parties may download the application and will have access to review all the securities that trade on Upstream including trading activity, regulatory disclosures, and other corporate information. Further there is a direct link of information on our Company at https://upstream.exchange/GeniusGroup. All information is available prior to the account opening process and application. This includes a listing particulars document, which is a required disclosure as part of the requirements of MERJ Exchange Limited as defined by Securities Act 2007 (as amended) of the Seychelles and any other measure prescribed thereunder by the Minister or the Securities Authority. The Upstream market is open 5 days a week 20 hours a day, Monday to Friday: 10:00am to 06:00am UTC+4 (1:00am to 9:00pm EST).

The Upstream policy, terms, and conditions, also clearly state that if you are a U.S. or Canadian based investor, either a Canadian citizen, U.S. citizen or permanent resident, you will not be able to buy shares on the Upstream secondary market. However, U.S. and Canadian citizens may sell securities they previously purchased from an issuer, stockbroker or stock exchange that has dual-listed on Upstream for liquidation only and will not be permitted to purchase any securities on Upstream. Note that U.S. or Canadian-based investors include those U.S. or Canadian citizens who may be living abroad.

To open an account on Upstream you must pass KYC. Upstream KYC does not rely on IP address monitoring or IP address analysis to identify a US person or a US-originating transaction, as this is too easily spoofed using VPN technologies. All Upstream users (US and overseas) are required to have passed a KYC review by Upstream personnel. Upstream determines whether a person is US domiciled or is a US person living overseas and restricts the app’s functionalities accordingly. There are no defaults pending-KYC-review, only after a full KYC review by Upstream personnel are any securities transactions permitted. Upstream requires the following KYC information to be supplied by users: name, date of birth, citizenship, cell phone, email address, postal address, bank account (no 3rd party transfers), selfie, photo ID, liveness detection in-app interview, GPS location or utility bill, and to verify an SMS code sent to the cell phone. Post KYC due diligence, the users’ details are also subjected to enhanced due diligence for AML, and these details are checked against international AML lists (ref: https://amlcop.com/). Users flagged as an AML risk are not permitted to trade on Upstream.

Investors may choose to open an account and deposit their securities. Investors who elect to transfer their shares to Upstream may withdraw their shares from Upstream back to the transfer agent if they choose to trade via their US broker at any time.

Investors may access detailed information on the process on how to deposit and trade shares on Upstream directly on our website at the following link: https://upstream.exchange/SupportCenter#how-to-deposit-shares-as-an-existing-investor-vstock

To dual list on Upstream, we executed a certificate of appointment of MERJ Depository and Registry Limited as a Securities Facility and confirmed that the shares outstanding on the date of the certificate execution (a) are duly authorized, validly issued, fully paid and non-assessable and any pre-emptive and other contractual rights related to all issuances of the shares have been satisfied, and (b) have been registered under the applicable law of the domicile of the company or are exempt from registration. All issuances and transfers of company shares have been, and after the date of the certificate will be, in compliance with all applicable laws, rules and regulations. The company requires MERJ Dep. to provide services (“Securities Facility Services”) as prescribed in the MERJ Dep Securities Facility Rules, including the Directive on Depository Interests and MERJ Dep. Procedures as a requirement of its listing on Upstream.

MERJ Dep. is a company licensed as a Securities Facility pursuant to the Seychelles Securities Act, 2007. The Issuer that lists its Securities on the Seychelles Securities Exchange, operated by MERJ Exchange Ltd., known as Upstream, utilizes MERJ Dep. to provide Securities Facility Services to manages it securities as prescribed in an agreement with the Issuer and pursuant to the MERJ Dep.’s Securities Facility Rules, including the Directive on Depository Interests and MERJ Dep. procedures as a requirement of its listing on MERJ Exchange Ltd. The Issuer appoints MERJ Dep. to act as the Depository Nominee in respect of any securities traded which are quoted on Upstream and grants MERJ Dep. as the Depository Nominee, pursuant to the Securities Facility Rules Directive on Depository Interests.

MERJ Dep. operates as a nominee account (street name) in the same manner as CEDE & Co, that accepts shareholder deposits in an electronic form from the transfer agent that facilitates the buying and selling of such shares on Upstream (e.g., by an individual name & address). Upstream is the trading technology employed by MERJ Exchange Ltd., a regulated national stock exchange.

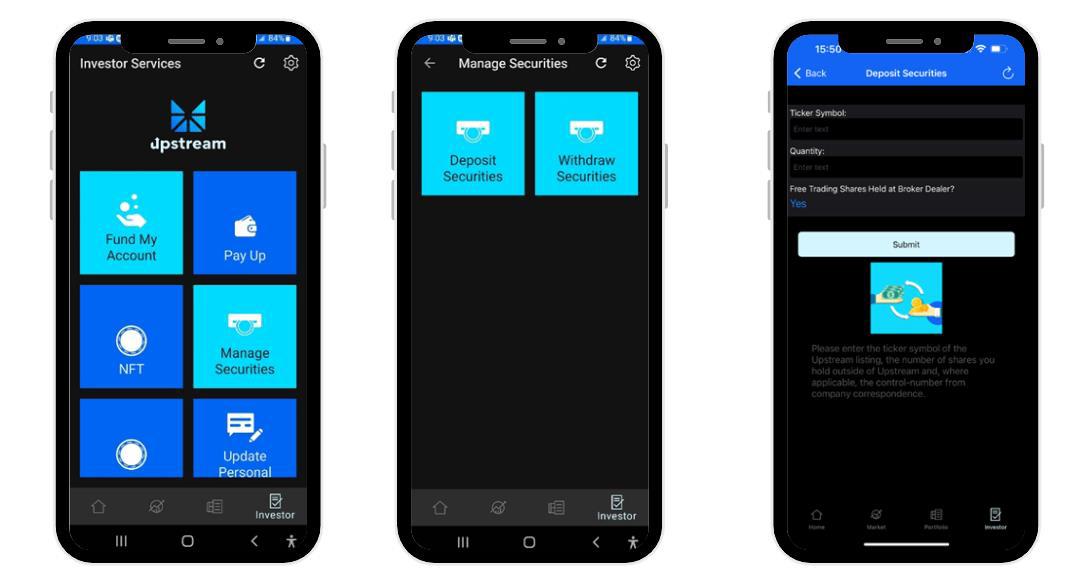

Shares may only be deposited on to Upstream through our transfer agent Vstock Transfer utilizing the Upstream app. Existing shareholders may transfer their shares by opening Upstream, tapping Investor, Manage Securities, Deposit Securities, then entering the ticker symbol and the number of shares to deposit, and tapping Submit. Next, enter your brokerage firm name and brokerage account number, and tap Submit. Finally, tap Add E-Signature, sign your name on the screen using your finger, tap Done, and then tap Sign. Shareholders will receive a push notification once the shares are deposited and available for trading on Upstream. After completion of the deposit request on Upstream, shareholders will receive via email an executed deposit form to submit to their current brokerage firm to initiate a withdraw to the transfer agent. Shares will not be transferred without notifying the current broker and requesting a withdraw. On listing day, shareholders will receive a push notification once the shares are deposited and available for trading on Upstream.

Investors may withdraw shares from Upstream directly from the Upstream app. The Upstream app has a function under Investor Services, Manage Securities, Withdraw Securities. The shareholder then enters the ticker symbol and the number of shares to being withdrawn and taps ‘Notarize’ to cryptographically sign this transaction. The shares are removed from the users Upstream portfolio and an email is sent to the transfer agent with a share withdrawal request whereafter the transfer agent will liaise directly with the shareholder to ensure the share balance is entered in ‘book entry’ into the users name & address. Third party share withdrawals from Upstream are not permitted, the share withdrawal request name and address (as retrieved from the Upstream KYC information by Upstream compliance) is required to be the same name and address that will be entered in the transfer agents ‘book entry’ for this shareholder.

Upstream only offers self-directed trading. Upstream users create a trading account using the Upstream smartphone app, with a random-generated username (in the form of an address that’s a 42-character hexadecimal address derived from the last 20 bytes of a random public key) and a password (in the form of a random cryptographic private key).The public and private key (the cryptographic keypair) is generated locally on the smartphone and only the public key is ever known to Upstream, MERJ Dep., or peer to peer trading counterparties on Upstream. Only the individual users hold their private keys. This privacy ensures that only the Upstream user can cryptographically sign a securities transaction (bid/offer/buy/sell/cancel) for it to be executed on Upstream, that is, all transactions such as share sales are self-directed, peer to peer, and instantly settled using the Upstream distributed ledger platform.

In order to buy, sell, deposit or withdraw shares on Upstream, an Upstream user that has created their account as outlined in the previous paragraph, is required to submit know your customer (KYC) information for the Upstream compliance team to review. KYC information is then linked to the users public key, and if the user passes KYC review, then this users cryptographic keypair’s transactions will be accepted as legitimate self-directed securities transaction requests to Upstream for execution on the platform.

It should be noted that the Upstream technology will reject securities buy orders from cryptographic keypair’s that, pursuant to their KYC review, come from U.S. or Canadian persons. No securities buy orders are accepted without a user having successfully undergone the Upstream KYC review process.

It should be also noted that individual shares traded on the Upstream secondary market are not reflected in the transfer agents books and records. They are recorded inside the street name depository of MERJ Dep. The MERJ Dep. nominee books and records service will only accept self-directed, cryptographically signed, executed securities sales from the Upstream app and adjust the share counts accordingly. Therefore, the securities are held at the nominee, and are moved between accounts inside the nominees omnibus solution pursuant to a cryptographically signed, self-directed instruction from the shareholder as executed by the Upstream matching-engine and notified to MERJ Dep.

HOW TO DEPOSIT SHARES

Upstream can accept the shares that investors hold in their current brokerage account, shares that are held at the transfer agent in digital book entry, or your physical stock certificate. Shares can be moved out of Upstream back to US markets. The following steps detail how investors can deposit their shares on to Upstream.

STEP 1. CREATE AN ACCOUNT ON UPSTREAM & VERIFY YOUR IDENTITY

| ● | Download Upstream and tap Sign Up. This will create your blockchain profile and ‘signing key’. | |

| ● | Complete KYC. To complete KYC identity verification, tap the settings icon in the top right of the navigation, then tap KYC. Be sure to have a valid form of ID and banking details handy. It’s important that bank account information matches your name exactly. | |

| ● | Once your account is approved, and if you already own shares and wish to transfer them to Upstream for trading, then you may initiate a request to deposit your shares using the Upstream app. |

STEP 2. TRANSFER SHARES TO TRANSFER AGENT

If your shares are already held at the transfer agent, then skip to STEP 3 below. However, if your shares are currently in your brokerage account, then please transfer your shares to the transfer agent as described below. Note, the terminology for this is to have shares held as ‘direct registration’ in ‘book entry’ at the transfer agent.

To make this transfer request, most of the time all you need to do is contact your brokerage firm by email and ask them to transfer your shares back to ‘book entry’ at the transfer agent. The brokerage firm will know what to do, and they will let you know how long it will take, but typically you should allow 48 hours for them to process your request.

Some brokerage firms may ask you to fill out their particular share transfer form. Upstream can be contacted at servicedesk@upstream.exchange if you need assistance in completing a share transfer form from your brokerage firm.

It is important that the investors name, address and social security number that their shares are registered under at the brokerage firm match the information that they provided when opening their account on Upstream. If their address at the brokerage firm is out of date, then they will need to update it with their brokerage firm BEFORE they transfer their shares to the transfer agent. Note, if the addresses do not match the investors address on Upstream, then their share deposit to Upstream will be delayed by the transfer agent.

STEP 3. REQUEST TO DEPOSIT SHARES USING THE UPSTREAM APP

Open Upstream, Tap Investor, Manage Securities, Deposit Securities. Next, Enter the Company’s Ticker Symbol and Number of Shares you’re requesting to deposit. Confirm whether your shares are free trading or restricted, then tap Submit.

The value of each share deposit request on the Upstream app may not exceed $100,000. This value is determined by the closing price of the security on the previous trading day multiplied by the number of shares being deposited.

Once the investor makes the share deposit request using the Upstream app, and the transfer agent has their shares in ‘book entry’, then most of the time the Upstream deposit process typically completes within 48 hours (Monday to Friday, excluding U.S. holidays).

However, if the transfer agent requires further information regarding their share transfer, then the investor will receive an email with a form to complete. The form will be pre-populated with the Upstream account information.

Once the transfer is complete investors will receive a push notification in the Upstream app and will see the share deposit in their Upstream Portfolio.

STEP 4. TRADING ON UPSTREAM

Once the shares are in the investors account, they may trade on Upstream. Investors may view their shares in the Upstream Portfolio. For more information on trading, visit Upstream’s support center at https://upstream.exchange/SupportCenter

Transfer agent information

Name:

Vstock Transfer

Address: LLC 18 Lafayette Pl, Woodmere, NY 11598

Phone: 212.828.8436

Toll-Free: 855-9VSTOCK

Fax: 646-536-3179

Email: info@vstocktransfer.com info@vstocktransfer.com

HOW TO MOVE SHARES BACK TO US MARKETS

Step 1. Open Upstream, Tap Investor, Withdraw Securities. Enter Ticker Symbol and the Number of Shares you wish to withdraw, then tap Submit.

Step 2. The transfer agent will receive the investors shares immediately and will hold them in digital book entry in their name.

Step 3. The transfer agent will provide the investor via regular US mail a DRS Advice (Statement) that shows their shares are now held at the transfer agent in book entry. If investor would like to move the shares back to their US brokerage account, they will need to contact their broker, provide them with a copy of their DRS Advice and have them request that the transfer agent send back the investors shares. The broker will provide the investor with appropriate forms to complete.