UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of September, 2023

Commission File Number: 001-41353

Genius Group Limited

(Translation of registrant’s name into English)

8 Amoy Street, #01-01

Singapore 049950

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ________.

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ________.

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Shareholder Approved Spinoff of Entrepreneur Resorts, Ltd. from Genius Group, Ltd. - Introduction

On January 30, 2023, Genius Group, Ltd. (the “Company” or “GNS”) first announced its intention to spin off (the “Spinoff”) of its 95% owned subsidiary, Entrepreneur Resorts, Ltd. (“ERL”) from GNS in order for GNS to focus on its core business, education. This Spinoff by the Company’s shareholders at its Extraordinary General Meeting held on May 16, 2023. At that Meeting, an overwhelming majority (over 93%) of the GNS shares voted in favor of the Spinoff.

On August 1, 2023, the Singapore High Court approved the spinoff of ERL from Genius Group, with a capital reduction and share distribution to all Genius Group shareholders at the record date of US$38,380,873 in market value and US$31,000,000 in book value in the form of restricted ordinary shares in ERL.

ERL is currently listed as a public company on the MERJ Stock Exchange in the Seychelles. Genius Group is now commenced the process to transfer ERL to the Upstream Exchange, which is a blockchain based exchange in partnership with MERJ. This process is anticipated to be completed within 30 days.

Genius Group has set the record date for a full share count of its shares for the purpose of the distribution as August 31, 2023.

Shareholders who hold shares of Genius Group on the record date (i.e.. Shares purchased and held 2 days or more prior to August 31, 2023) will be entitled to receive an equal proportion of shares in Entrepreneur Resorts Ltd at the share distribution date.

Genius Group has set the share distribution date of ERL on or about September 29, 2023. All shareholders entitled to the distribution will be notified in September 2023. All shareholders will receive restricted shares in ERL, which may be freely traded on Upstream Exchange six months after the share distribution date, after strict compliance with all requirements under Rule 144, promulgated under the Securities Act of 1933, are met.

Following the share distribution, Genius Group and ERL will trade as separate public companies, with Genius Group dual listed on NYSE American and Upstream Exchange (Ticker: GNS), and ERL listed on Upstream Exchange (Ticker: ERL).

Instructions for Shareholders to Partake in the Spinoff

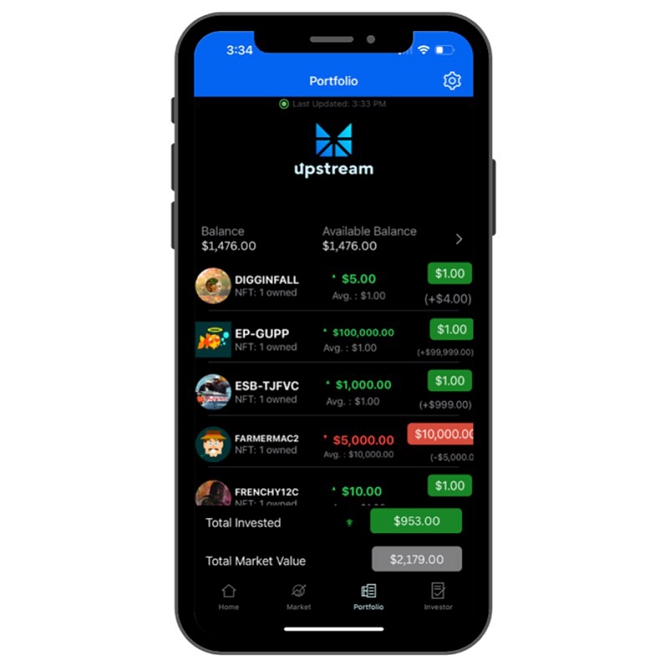

Overview: All GNS shareholders as of the record date August 31st (i.e., shares purchased and held 2 days or more prior to August 31, 2023) will be entitled to receive an equal proportion of shares in Entrepreneur Resorts Ltd (ERL) on distribution date, which is expected to be on or about September 29th. The shares received in the spin-off will have the symbol ERLR in your Upstream portfolio.

Steps on how to receive your ERL shares can be downloaded on this link or you can follow the steps described below.

IMPORTANT* You won’t be able to request your share distribution in the Upstream app until mid-September, exact date to be announced, as that is when shareholders are expected to begin receiving their brokerage statements that show shareholding as of the August 31 record date.

STEP ONE: GET READY FOR THE DISTRIBUTION DATE

| 1. | Download Upstream from the Apple App Store or the Google Play Store and tap Sign Up. | |

| 2. | Complete KYC identity verification by tapping the settings icon at the top right of the app home screen and tapping KYC. Have an ID handy. KYC reviews typically within 2-4 business days. |

STEP TWO: CREATE AN ACCOUNT ON BOUSTEAD & ACTIVATE SECURITIES TRADING ON UPSTREAM (REQUIRED FOR U.S. SHAREHOLDERS ONLY):

Important: U.S. Investors may only participate in the ERL share distribution on Upstream after creating an account at a licensed introducing broker dealer. Boustead Securities, a leading full-service investment banking firm and licensed FINRA member, is an introducing broker dealer for Upstream. If you’re not a U.S. shareholder, please skip STEP TWO and move on to STEP THREE.

| 1. | Create a Boustead account |

| ○ | Visit https://www.boustead1828.com/upstream, tap Register Now, and enter the requested details (have ID handy, takes about 10 minutes). |

| 2. | Activate securities trading on Upstream |

| ○ | Once your KYC identity verification has been approved on Upstream and you’ve received an email confirming KYC approval, you can unlock the securities trading feature on Upstream by following the steps below on the Upstream app: |

| ○ | Open the Upstream app. |

| ○ | Tap Investor. |

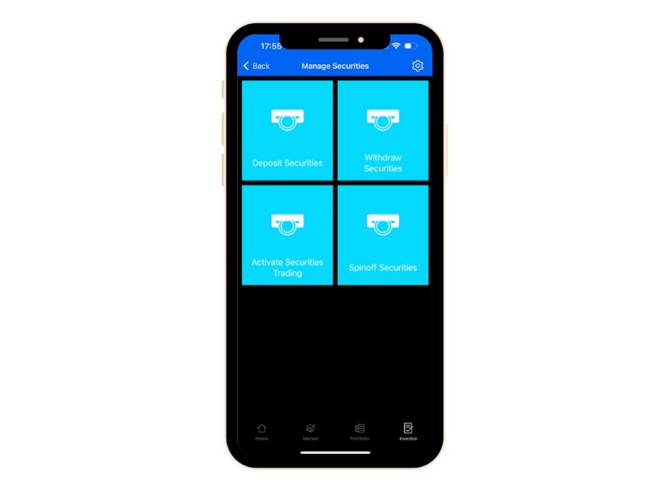

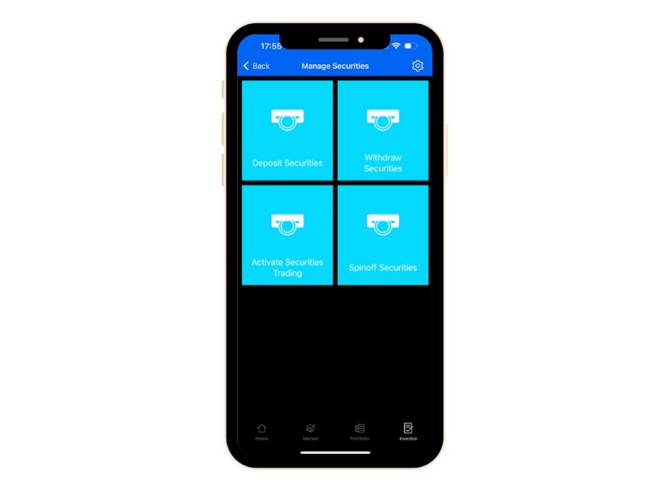

| ○ | Tap Manage Securities. |

| ○ | Tap Activate Securities Trading. |

| ○ | Once verified by Boustead, traders will be notified in the Upstream app that they may begin trading or depositing securities on Upstream. |

STEP THREE: REQUEST YOUR SHARE DISTRIBUTION & VERIFY SHAREHOLDING

IMPORTANT* You won’t be able to request your share distribution in the Upstream app until mid-September, exact date to be announced, as that is when shareholders are expected to begin receiving their brokerage statements that show shareholding as of the August 31 record date.

Once you have your brokerage statements confirming your shareholding as of the record date August 31, 2023, please proceed to claim your shares on the Upstream app.

Be sure your KYC identification has been approved on Upstream and if you’re a U.S. shareholder, please also be sure that you’ve created an account at Boustead and activated securities trading on Upstream by following STEP TWO instructions.

Now you’re ready to request your ERL shares on Upstream. Please note that share allocation to Upstream accounts will not begin until the ERL distribution date.

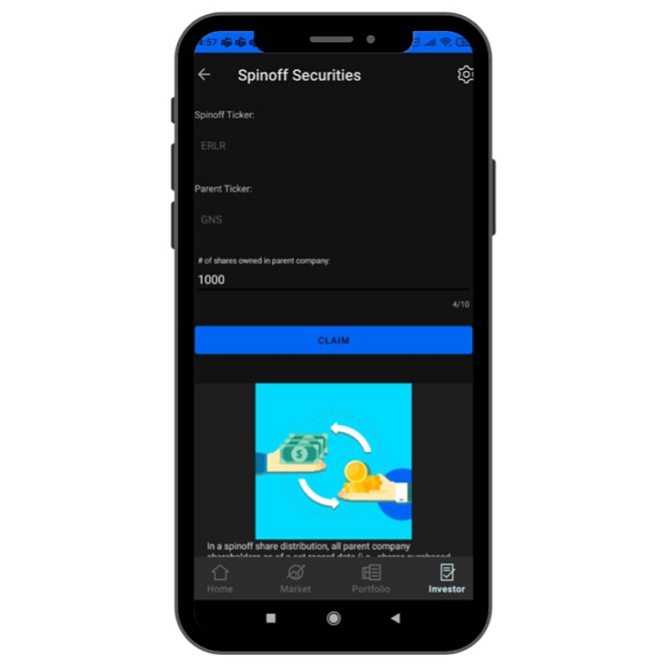

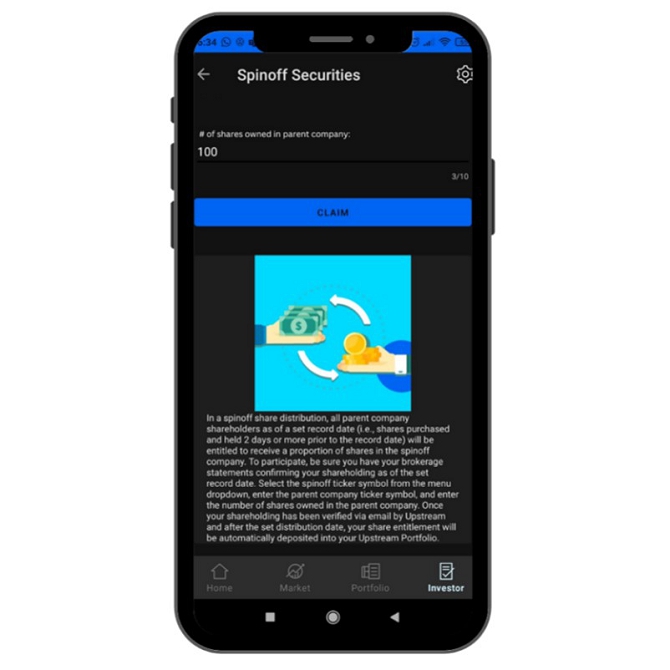

| 1. | On the Upstream app, tap Investor, Manage Securities, then tap Spinoff Securities. |

| 2. | Select the spinoff ticker symbol “ERLR” from the menu dropdown, select the parent company ticker symbol “GNS”, and enter the number of shares owned in the parent company “GNS” as of the record date August 31, 2023. Note: Share entitlement will be the number of GNS shares you held as of the record date divided by a spinoff ratio of 0.1832 shares of ERL for every share of GNS. It is extremely important that you enter the correct number of shares owned in the parent company as of the record date. Any variation may result in delayed share delivery and additional information requests. |

| 3. | Tap Claim. |

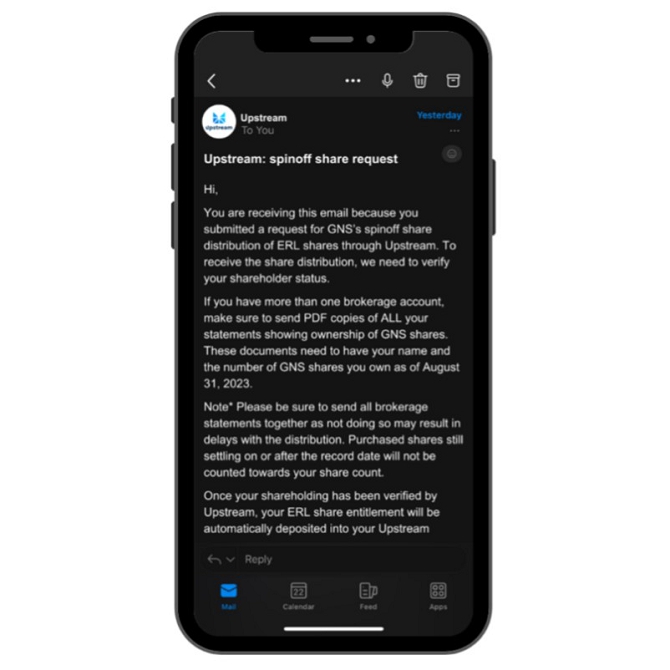

| 4. | Upstream will send you an email to verify your shareholding. You’ll be asked to send a copy of your brokerage statement(s) via email showing your GNS shareholding as of the record date August 31, 2023 (i.e., GNS shares purchased and held 2 days or more prior to August 31, 2023). |

| 5. | Once your shareholding has been verified by Upstream and after the distribution date, your ERL share entitlement will be automatically deposited into your Upstream Portfolio under the ticker symbol ERLR. You’ll receive a push notification in the Upstream app announcing their delivery. Shares may take up to 5 business days to post to your Upstream portfolio. |

| 6. | All shareholders will receive restricted shares in ERL under ERLR, which may be eligible for removal of restrictions and traded on Upstream six months after the share distribution date, if certain requirements are met. |

FAQs

WHAT IS THE ERL SHARE DISTRIBUTION?

On August 1, 2023, the Singapore High Court approved the spinoff of ERL from Genius Group, with a capital reduction and share distribution to all Genius Group shareholders at the record date of US$38,380,873 in the form of restricted ordinary shares in ERL, pursuant to a private placement transaction exempt from registration under the provisions of the Securities Act of 1933, as amended.

ERL is currently listed as a public company on the main board of MERJ Exchange in the Seychelles. Genius Group has now commenced the dual listing process to transfer ERL to Upstream, a new non-US MERJ Exchange market. This process is anticipated to be completed within 30-45 days.

Genius Group has set the record date for a full share count of its shares for the purpose of the distribution as August 31, 2023.

Following the share distribution date on or about September 29, 2023, shares of Genius Group and ERL will trade as securities of two separate public companies, with Genius Group dual listed on NYSE American and Upstream (Ticker: GNS), and ERL listed on Upstream (Ticker: ERL). Note: shares received in the spinoff are restricted for a period of six months and will be represented in your Upstream portfolio under the symbol ERLR.

WHO CAN PARTICIPATE IN THE ERL SHARE DISTRIBUTION?

Shareholders who hold shares of Genius Group on the record date (i.e., shares purchased and held 2 days or more prior to August 31, 2023) will be entitled to receive an equal proportion of the total shares in Entrepreneur Resorts Ltd to be distributed at the share distribution date. The exact per share rate will be announced to shareholders soon after the record date.

Genius Group has set the share distribution date of ERL on or about September 29, 2023. All shareholders entitled to the distribution will be notified in September 2023. All shareholders will receive restricted shares in ERL, which may be eligible for removal of restrictions and traded on Upstream six months after the share distribution date, if certain requirements are met.

HOW DO I PARTICIPATE?

Shareholders won’t be able to do the share distribution request in the Upstream app until mid-September as that is when shareholders are expected to begin receiving their brokerage statements that show their shareholding as of the August 31st record date.

Shareholders can follow STEP ONE and STEP TWO (if a U.S. shareholder) above which includes downloading Upstream, signing up with a password, and completing KYC on Upstream. U.S. shareholders must create an account on Boustead and activate securities trading on the Upstream app.

After shareholders receive their brokerage statements verifying shareholding as of the set record date, shareholders may then request their ERL share entitlement on the Upstream app, then verify shareholding by replying to the Upstream shareholder verification email with copies of your brokerage statements showing GNS shareholding as of the record date August 31, 2023. Please note that spinoff share allocations to Upstream accounts will not begin until the distribution date.

Beginning on the ERL distribution date, shares will begin to be delivered to your Upstream portfolio.

WHEN WILL I RECEIVE MY ERL SHARES?

Once your shareholding has been verified by Upstream and after the distribution date which is on or around September 29, 2023, your ERL share entitlement will be automatically deposited into your Upstream Portfolio under the ticker symbol ERLR. You’ll receive a push notification in the Upstream app announcing their delivery. Shares may take up to 5 business days to post to your Upstream portfolio.

HOW MANY ERL SHARES WILL I BE RECEIVING?

The number of ERL shares that will be distributed to shareholders will be proportional to the number of shares that you hold in GNS. The exact ratio has been determined as of the record date and is 0.1832.

DO SHAREHOLDERS NEED TO TRANSFER SHARES TO UPSTREAM BEFORE CLAIMING ERL SHARES?

No. Shareholders just need to download Upstream, sign up, and complete KYC. After the record date and after receiving your brokerage statements that show your shareholding as of the record date August 31, 2023, you may use the Upstream app to request to claim the ERL shares. If you’re a U.S. shareholder, you’ll also need to create a Boustead account and activate securities trading on the Upstream app by following STEP TWO instructions.

CAN SHAREHOLDERS TRADE IMMEDIATELY AFTER RECEIVING THEIR ERL SHARES?

No. All shareholders will receive restricted shares in ERL under the symbol ERLR, which may be eligible for removal of restrictions and traded on Upstream six months after the share distribution date, if certain requirements are met.

WHY DOES UPSTREAM REQUIRE KYC?

To be included on the shareholder registry of a company, a shareholder’s name and address must be known. Furthermore, Upstream, a MERJ Exchange Market, is a regulated securities marketplace and verifying that you are who you say you are is legally required for you to trade safely and securely. Such verifications are used to assist in the prevention of money laundering, illicit activity, and bad actors from entering the Upstream community.

HOW LONG DOES IT TAKE FOR KYC TO BE APPROVED ON UPSTREAM?

Assuming you have provided the appropriate KYC information, approvals can be as fast as 15 minutes and, depending on date, time and queue, it could take up to 72 hours, Monday to Friday. If additional information is required, or if Upstream has many submissions awaiting approval, it could take up to 2 weeks.

WHAT DOES IT MEAN THAT UPSTREAM IS A MERJ EXCHANGE MARKET?

Upstream is a MERJ Exchange market (MERJ). MERJ operates a fully regulated and licensed integrated securities exchange, clearing system and depository for digital and non-digital securities. MERJ is an affiliate member of the World Federation of Exchanges (WFE), a member of the African Stock Exchanges (ASEA), a member of the Committee of SADC Stock Exchange (CoSSE), a full member of the Association of National Numbering Agencies (ANNA) and a Qualifying Foreign Exchange for OTC Markets in the U.S. MERJ became one of the fastest growing exchanges in 2020 by disrupting the traditional stock exchange model.

WHAT IS MERJ EXCHANGE?

MERJ Exchange is an innovative end-to-end, multi-market global financial exchange for equities, debt and derivatives. MERJ has expanded its capabilities by providing markets and services for security tokens and digital assets. Visit https://merj.exchange/.

HOW CAN I GET MORE SUPPORT USING THE UPSTREAM APP? ARE THERE ANY CAVEATS?

Please visit Upstream’s support center at https://upstream.exchange/supportcenter.

NFTs received have no economic value, royalties, equity ownership, or dividends with exception of the $10 coupon being issued. NFTs are for utility, collection, redemption and display only.

*U.S. or Canadian-based citizens or permanent residents may only deposit, buy, or sell securities on Upstream after being introduced by a licensed broker dealer. Note that U.S. or Canadian-based investors include those U.S. or Canadian citizens who may be domiciled overseas. All orders for sale are non-solicited by Upstream and a user’s decision to trade securities must be based on their own investment judgement. Anyone may buy and sell NFTs on Upstream.

Upstream is operated as a fully regulated and licensed integrated securities exchange, clearing system and depository for digital and non-digital securities. MERJ is an affiliate of the World Federation of Exchanges (WFE), recognized by HM Revenue and Customs UK, a full member of the Association of National Numbering Agencies (ANNA), a Qualifying Foreign Exchange for OTC Markets in the US, and a member of the Sustainable Stock Exchanges Initiative. MERJ is regulated in the Seychelles by the Financial Services Authority Seychelles, https://fsaseychelles.sc/ an associate member of the International Association of Securities Commissions (IOSCO). MERJ supports global issuers of traditional and discount securities through the entire asset life cycle from issuance to trading, clearing, settlement, and registry. It operates a fair and transparent marketplace in line with international best practices and principles of operations of financial markets. Upstream does not endorse or recommend any public or private securities bought or sold on its app. Upstream does not offer investment advice or recommendations of any kind. All services offered by Upstream are intended for self-directed clients who make their own investment decisions without aid or assistance from Upstream. All customers are subject to the rules and regulations of their jurisdiction. By accessing the site or app, you agreed to be bound by its terms of use and privacy policy. Company and security listings on Upstream are only suitable for investors who are familiar with and willing to accept the high risk associated with speculative investments, often in early and development stage companies. There can be no assurance the valuation of any particular company’s securities is accurate or in agreement with the market or industry comparative valuations. Investors must be able to afford market volatility and afford the loss of their investment. Companies listed on Upstream are subject to significant ongoing corporate obligations including, but not limited to disclosure, filings, and notification requirements, as well as compliance with applicable quantitative and qualitative listing standards. Investors are encouraged to take note that as in all dual listed securities that are traded on multiple marketplaces, there can be differences in pricing as a result of different liquidity, price discovery and otherwise. Trading on foreign exchanges can expose investors to various risks, including currency fluctuations and differences in trading rules and regulations. Here are some of the most common risks associated with trading on foreign exchanges like Upstream: 1. Regulatory Risk: Different countries have different rules and regulations governing securities trading, and investors who trade on foreign exchanges may be subject to unfamiliar or complex regulations. In some cases, foreign regulators may have different reporting requirements or different standards for disclosure than US regulators, which can make it difficult for investors to make informed decisions. 2. Market Risk: Foreign markets may be subject to different economic, political, or social conditions than US markets, which can affect the performance of securities traded on those markets. Investors who trade on foreign exchanges may be exposed to higher levels of volatility and uncertainty than they would be if they traded solely on US exchanges. 3. Liquidity Risk: Securities traded on foreign exchanges may have lower liquidity than comparable securities traded on US exchanges, which can make it more difficult for investors to buy or sell those securities at the desired price. 4. Operational Risk: Trading on foreign exchanges may also expose investors to operational risks, such as delays or errors in the settlement of trades or difficulties in accessing trading platforms.

Details on Entrepreneur Resorts Limited

On the Announcement Date, the Company announced, inter alia, that the Directors of the Company have, on January 18, 2023, approved the proposed spinoff of ERL owned by the Company to Shareholders as part of a rationalization of the Company and Group’s business, and to create shareholder value for our shareholders.

On January 31, 2023, Genius Group, Ltd. (the “Company” or “GNS”) first announced its intention to spin off (the “Spinoff”) of its 95% owned subsidiary, Entrepreneur Resorts, Ltd. (“ERL”) from GNS in order for GNS to focus on its core business, education. This Spinoff by the Company’s shareholders at its Extraordinary General Meeting held on May 16, 2023. At that Meeting, an overwhelming majority (over 93%) of the GNS shares voted in favor of the Spinoff.

On August 1, 2023, the Singapore High Court approved the spinoff of ERL from Genius Group, with a capital reduction and share distribution to all Genius Group shareholders at the record date of US$38,380,873 in the form of restricted ordinary shares in ERL.

ERL is currently listed as a public company on the MERJ Stock Exchange in the Seychelles. Genius Group is now commenced the process to transfer ERL to the Upstream Exchange, which is a blockchain based exchange in partnership with MERJ. This process is anticipated to be completed within 30 days.

Genius Group has set the record date for a full share count of its shares for the purpose of the distribution as August 31, 2023.

Shareholders who hold shares of Genius Group on the record date (i.e.. Shares purchased and held 2 days or more prior to August 31, 2023) will be entitled to receive an equal proportion of shares in Entrepreneur Resorts Ltd at the share distribution date.

Genius Group has set the share distribution date of ERL on or about September 29 , 2023. All shareholders entitled to the distribution will be notified in September 2023. All shareholders will receive restricted shares in ERL, which may be freely traded on Upstream Exchange six months after the share distribution date, after strict compliance with all requirements under Rule 144, promulgated under the Securities Act of 1933, are met.

Following the share distribution, Genius Group and ERL will trade as separate public companies, with Genius Group dual listed on NYSE American and Upstream Exchange (Ticker: GNS), and ERL listed on Upstream Exchange (Ticker: ERL).

INFORMATION ON ENTREPRENEUR RESORTS LIMITED

ERL is a company incorporated under the laws of Seychelles, having its registered office at Global Gateway 8, Rue De La Perle, Providence, Mahe, Seychelles. ERL is a publicly listed company on the MERJ (Ticker: ERL). As at the Latest Practicable Date, the directors of ERL are Roger James Hamilton, Jeremy Justin Harris, Vilma Lisa Bovio, Dennis Owen Du Bois. As at the Latest Practicable Date, the issued and paid-up share capital of ERL is US$15,283,048 divided into 13,956,681 shares, and the Company owns 13,334,017 shares in the capital of ERL (“Relevant ERL Shares”), representing an approximate 95.37 per cent. equity interest in ERL. ERL has been listed on the MERJ since May 9, 2017. ERL wholly owns and operates five subsidiary companies: Entrepreneur Resorts Pte Ltd (Singapore), Genius Central Singapore Pte Ltd (Singapore), PT XL Vision Villas, Bali (Indonesia), Tau Game Lodge Pty Ltd (South Africa) and Matla Game Lodge Pty Ltd (South Africa).

ERL operates a range of resorts, retreats and co-working cafes for entrepreneurs and others , and operates campus venues for the Group’s education courses. ERL also owns and operates (i) resorts in Bali and South Africa which run retreats and workshops aimed at entrepreneurs and others, (ii) Genius Café, an entrepreneur beach club in Bali, and (iii) Genius Central, an entrepreneur co-working hub in Singapore. ERL owns and operates venues in three countries: Singapore, with 39 staff; Indonesia, with 65 staff; and South Africa, with 67 staff. In Singapore, it owns 177-seat Genius Central, an entrepreneur co-working hub, bar, restaurant and event space. In Bali, Indonesia, it owns the 17-room Vision Villa Resort and 160-seat Genius Café, an entrepreneur beach club. In South Africa, it owns the 30-room Tau Game Lodge and 7-room Matla Private Members’ Lodge, both safari lodges on the Madikwe Game Reserve. Each venue operates as a local campus for events and courses that take place on the Company’s educational technology platform, GeniusU. When GeniusU hosts global summits, accelerator programs and microschools live, they are also attended by groups at ERL’s campus venues, who then spend extra on food and beverage, accommodation and additional courses.

In July 2020, the Company acquired 98 per cent of the shares in ERL for US$31,000,000, with shareholders of ERL swapping their shares in ERL for US$31,000,000 worth of Shares in the Company.

Profit before Tax. Based on the Group’s FY2022 results, the profit before tax, non-controlling interests and extraordinary items for FY2022 attributable to ERL and the Relevant ERL Shares were approximately (US$2,288,261) and (US$2,186,172) respectively.

Net Asset Value (NAV). Based on the Group’s FY2022 results, the NAV of ERL as at December 31, 2022 and attributable to the ERL Shares and Relevant ERL Shares were approximately (US$73,863) and (US$70,568) respectively.

Market Value. As at the Latest Practicable Date, based on the one-month volume-weighted average price per ERL share of US$2.75 immediately preceding March 31, 2023, the open market value of ERL and the Relevant ERL Shares was approximately US$38,380,873 and US$36,668,547 respectively.

ENTREPRENEUR RESORTS: Entrepreneur Resorts has a different revenue model from the education companies in the Group, and it complements the education companies by providing location-based campuses that link local mentors and partners to local students while hosting courses delivered via GeniusU and generating income from food, drink and accommodation. By providing venues for the delivery of Genius Group courses, the company practices the same elements of the Genius Curriculum.

| ➢ | Entrepreneur Education Vision: As with Entrepreneurs Institute, prior to acquisition Entrepreneur Resorts also shared a similar entrepreneur education vision to GeniusU, but limited to each venue’s location. After the acquisition, Entrepreneur Resorts is expanding on that vision with partners and course content growing via GeniusU. |

| ➢ | 8 “Education 4.0” Pillars: Entrepreneur Resorts was originally established to provide venues for Entrepreneurs Institute, and so shared the same focus on developing skills in some of the “Education 4.0” pillars, including global citizenship, creativity, technology, interpersonal skills, and included collaborative and personalized learning. It also did not address the pillars of accessible and lifelong learning. After the acquisition, the company was challenged by government restrictions during the COVID-19 pandemic. As our venues have been reopening, the company has plans to address these pillars as it has expanded its course calendar in the different venues. | |

| ➢ | Genius Learning Methodology: The students who attend courses at Entrepreneur Resorts venues do develop their own personalized discovery-based learning path based on “andragogy”. Since the acquisition, the growth of students, partners and courses on GeniusU has enabled the company’s venues to grow its reputation in delivering discovery-based and challenge-based courses. | |

| ➢ | 10 Genius Principles: Entrepreneur Resorts was also similar to Entrepreneurs Institute in the Genius Principles it was following prior to acquisition, including personalized learning, challenge- based courses, global classroom, leading learners and leadership skills. Also similar to Entrepreneurs Institute, after the acquisition, the company also now has the tools to introduce the Genius Principles of a positive credit system, decentralized system, inclusive entry and a lifelong learning pathway, with plans to include these, post-pandemic. | |

| ➢ | C.L.E.A.R. Philosophy: Entrepreneur Resorts also focused on the first two elements of the C.L.E.A.R. Philosophy, connecting and learning, in its events prior to the acquisition. Now that the venues will be hosting more courses and conferences delivered partly on GeniusU and partly with in-person faculty partners and community partners, the company plans to introduce the other elements of the CL.E.A.R. Philosophy. |

Entrepreneur Resorts

Entrepreneur Resorts Limited is one of the four companies in the Pre-IPO Group. The company is a Seychelles public listed company on the Seychelles Merj Stock Exchange (Ticker: ERL). Entrepreneur Resorts was acquired by Genius Group in August 2020. The company in turn wholly owns and operates five subsidiary companies: Entrepreneur Resorts Pte Ltd (Singapore); Genius Central Singapore Pte Ltd, Vision Villa Resorts Pte Ltd (Indonesia); Tau Game Lodge (South Africa); and Matla Game Lodge (South Africa).

In August 2020, Genius Group Ltd acquired 98% of the shares of Entrepreneur Resorts and its subsidiaries for $31 million, with Entrepreneur Resorts shareholders swapping their shares for $31 million of Genius Group Ltd shares.

The company currently owns and operates venues in three countries: Singapore, with 39 staff; Indonesia, with 65 staff; and South Africa, with 67 staff. In Singapore, it owns Genius Central, an entrepreneur co- working hub, bar, restaurant and event space. In Bali, Indonesia, it owns Vision Villa Retreat and Genius Café, an entrepreneur beach club. In South Africa, it owns Tau Game Lodge and Matla Lodge, both safari lodges on the Madikwe Game Reserve. Each venue operates as a local campus for events and courses that take place on GeniusU. When GeniusU hosts global summits, accelerator programs and microschools live, they are also attended by groups at our campus venues, who then spend extra on food and beverage, accommodation and additional courses.

In the fiscal year ended December 31, 2021, revenues were $3.1 million. This accounted for 37% of the revenue for the Group. In the fiscal year ended December 31, 2022, the revenue were $4.6 million which accounts for 17% of the pro forma group revenue.

During 2020, we divided our campus venues into the following three models: Our café model, our central model and our resort model. We then developed the operating systems and training systems during the COVID-19 pandemic to be able to expand the three models via licensing to venue partners post-pandemic.

Our Genius Café Model: Our Genius Café model is based on our Genius Café in Sanur. This is a 160-seat beach-front venue on Sanur Beach, Bali, with the land leased on an annual renewable basis with Mercure Hotel. The café offers healthy food, drinks, networking events, education courses and co-working for Bali’s entrepreneur community. It has developed a reputation as one of the top destinations for entrepreneurs in Bali and is currently ranked No.3 out of 431 restaurants in Sanur.

Our Genius Central Model: Our Genius Central model is based on our Genius Central in Singapore. This is a 177-seat bar, restaurant, education and co-working space for entrepreneurs in Far East Square, in the center of Singapore’s business district. The venue serves as a city campus for our education programs, and despite opening in March 2020 just as the COVID-19 pandemic began, it is gaining a reputation as a key destination for entrepreneurs in Singapore to meet and attend events.

Our Genius Resort Model: Our Genius Resort model is based on our three resort locations. Vision Villa Resort in Bali, based in Gianyar on the East Coast of Bali next to the Bali Safari Park, has 15 guest rooms, a conference center, spa and a Genius Café on site. Tau Game Lodge, in Madikwe Game Reserve in South Africa, has 30 guest rooms, a conference center, spa and daily safari drives. Matla Game Lodge, adjacent to Tau, is a Private Members’ lodge with 7 guest rooms and is managed by the same team that manages Tau. These venues have been hosting to GeniusU events and retreats, and our post-pandemic plan is to build a calendar of workshops and retreats that enable our students to attend our education programs in our resort locations.

During 2020, the Café model operated at 20% capacity with 37,185 orders and $342,238 revenue. The Central Model operated at 24% capacity with 36,182 orders and $500,629 revenue. The resort model operated at 26% capacity with 8,538 room nights and $1,172,699 revenue. In total, the locations operated at 24% capacity as a result of COVID-19.

In the meantime, we have utilized the additional time we have had during 2020 to develop our license model to attract venue partners to launch additional venues. We have created three models based on our café model, central model and resort model. In each model, venue partners pay $32,000 for initial training and consulting, in which we support the setup of the campus venue with setup support, brand guidelines, interior design review, construction support and pre-opening inspection. The venue partner then pays 4% of net sales on an ongoing basis as a royalty fee, and 4% of net sales on an ongoing basis for marketing and use of the GeniusU platform to manage their community and operations.

Since launching the license model in 2021, we have attracted venue partners in Australia, Japan, England, Greece and South Africa. Our plan is to continue to grow Entrepreneur Resorts via our license model, in order to provide a campus venue model for our community partners who seek a GeniusU campus in their city or location.

The vision of Entrepreneur Resorts is to launch 5 entrepreneur resorts and 50 entrepreneur beach clubs within the next 5 years. Both the resort model and beach club model have been launched and are operating with 20%+ profitability in Bali, with the roll- out plan now taking place with Entrepreneur Resorts in Seychelles serving as the international holding company.

THE PROPOSED CAPITAL REDUCTION AND DISTRIBUTION

Distribution in specie by way of Capital Reduction and the Distribution. As set out in above, the Company intends to undertake the Spinoff by way of a Capital Reduction and Distribution. Subject to the satisfaction of the Capital Reduction Conditions, the Company intends to undertake the Capital Reduction involving the Distribution of US$31,797,810 (“Distribution Amount”), representing the aggregate book value of the Relevant ERL Shares, to Shareholders by way of a proposed distribution in specie of all the Relevant ERL Shares, which represent the Company’s entire shareholding in ERL, free of encumbrances and together with all rights attaching thereto on and from the date on which the Distribution in specie is effected, to Shareholders on the basis of approximately 0.18 Relevant ERL Shares for each Share held as at the Books Closure Date. The figures in relation to the entitlement per Share pursuant to the Capital Reduction and Distribution have been rounded down to two decimal places and are provided for illustration purposes only. The final entitlement per Share pursuant to the Capital Reduction and Distribution will depend on the total number of issued Shares as at the Books Closure Date.

For practical reasons and in order to avoid any violation of applicable securities laws, the Relevant ERL Shares will not be distributed pursuant to the Distribution to Shareholders who are Excluded Overseas Shareholders. The Excluded Overseas Shareholders will receive cash in lieu of their pro-rata entitlements to Relevant ERL Shares pursuant to the Distribution, as further described below.

As at the Aug 31, 2023: the issued share capital of the Company comprises:

S$447,501 comprising 6,000,006 Shares denominated in SGD; and

US$125,068,886 comprising 67,473,778 Shares denominated in USD; and

there are 2,916,581 outstanding options (“Options”) granted under the Share Option Plan which are exercisable into 2,916,581 Shares denominated in USD;

and

there are outstanding conditional awards (“Awards”) granted under the Share Option Plan, none of which are expected to entitle holders thereof to the delivery of Shares on or before the expected Books Closure Date as the Company does not intend to vest any of the Awards.

For illustrative purposes, assuming that none of the Options are exercised1, the Company will have the following issued share capital at the Books Closure Date (“Projected Share Capital”):

S$447,501 comprising 6,000,006 Shares denominated in SGD; andUS$125,068,886 comprising 67,473,778 Shares denominated in USD.

1 The holders of the Options may elect to exercise their Options to subscribe for Shares denominated in USD in the period between the date of this Circular and the completion of the Spinoff.

On the basis of the Projected Share Capital, Shareholders (other than the Excluded Overseas Shareholders) will receive, for each Share held as at the Books Closure Date, 0.18 Relevant ERL Shares.2

For the avoidance of doubt, no payment will be required from Shareholders for the Distribution as this is a return of shareholder funds by the Company. The Capital Reduction and Distribution, if effected, will not result in a cancellation of Shares, or a change in the number of Shares, held by Shareholders immediately after the Capital Reduction and Distribution.

Illustration. The following illustrates the position of a Shareholder who holds 1,000 Shares as at the Books Closure Date, based on the Projected Share Capital of the Company, before and after the Capital Reduction and Distribution, if effected:

| Entitled Shareholder with 1,000 Shares as at the Books Closure Date | ||||

| Position prior to Capital Reduction and Distribution | ||||

| Shares currently held | 1,000 | |||

| Relevant ERL Shares currently held | 0 | |||

| Capital Reduction and Distribution | ||||

| Relevant ERL Shares received pursuant to the Distribution | 180 | |||

| Position after Capital Reduction and Distribution | ||||

| Shares held post-Capital Reduction | 1,000 | |||

| Relevant ERL Shares held post-Capital Reduction | 180 | |||

Capital Reduction Conditions. The Capital Reduction and Distribution are subject to the following conditions (“Capital Reduction Conditions”):

| ● | the approval of Shareholders, by way of a Special Resolution, for the Capital Reduction and Distribution at the EGM; |

2 For illustration purposes only, assuming that all of the outstanding Options as at the Latest Practicable Date have been exercised, and the Convertible Securities have been converted to Shares, the Company will have 72,782,550 Shares in issue (“Enlarged Share Capital”) as at the Books Closure Date, in which case the Company will have a total issued and paid-up share capital of (i) S$447,501 comprising 6,000,006 Shares denominated in SGD and (ii) US$125,068,886 comprising 67,473,778 Shares denominated in USD. The illustrative entitlement for each Share held as at the Books Closure Date pursuant to the Distribution based on the Enlarged Share Capital is not expected to be materially different from the illustrative entitlement set out in this paragraph based on the Projected Share Capital.

| ● | the approval of the Court for the Capital Reduction and Distribution; |

| ● | the lodgment of a copy of the Order of Court approving the Capital Reduction and Distribution with ACRA; |

| ● | the Capital Reduction and Distribution not causing or resulting in a breach of the financing documents of the Group; and |

| ● | all other relevant approvals and consents being obtained. |

| ● | Shareholders should note that the Capital Reduction and Distribution will only be effective upon the lodgment of a copy of the Order of Court approving the Capital Reduction and Distribution with ACRA. Accordingly, if the Board is of the view that it would not be in the best interests of the Company to effect the Capital Reduction and Distribution (for example, due to the then prevailing market or economic conditions or for any other reason), the Board may decide not to lodge a copy of the Order of Court approving the Capital Reduction and Distribution with ACRA and will make an announcement to that effect and take all necessary steps and action to terminate the Capital Reduction and Distribution exercise. |

| ● | Pro Forma Financial Effects. The pro forma financial effects of the Capital Reduction and Distribution (collectively, the “Transactions”) on the share capital, total equity, earnings, net tangible assets and gearing of the Group have been prepared based on the Group’s FY2022 results and are for illustrative purposes only, and do not necessarily reflect the actual future results and financial position of the Group after the Transactions, if effected. |

For the purposes of illustrating the financial effects of the Transactions, the pro forma financial effects of the Transactions are computed based on, inter alia, the following bases and assumptions:

none of the Awards and Options has been exercised or vested, as the case may be; and the Distribution Amount of US$31,797,810 will be distributed out of the Group pursuant to the Capital Reduction and Distribution.

The book value of ERL as at December 31, 2022 was approximately (US$73,863). An amount of approximately US$31,871,673, representing the excess of the Distribution Amount over the book value of ERL, has been credited to retained earnings and other reserves.

Share Capital. For purely illustrative purposes only and based on the Projected Share Capital, the pro forma financial effects of the Transactions on the share capital of the Company are set out below:

Before the Transactions

|

After the Transactions

| |||

Share Capital |

S$447,501 and US$125,068,886 | S$447,501 and US$125,068,886 | ||

| Number of Shares in issue | 6,000,006 Shares denominated in SGD and 67,473,778 Shares denominated in USD | 6,000,006 Shares denominated in SGD and 67,473,778 Shares denominated in USD |

| 1.1.1 | Total Equity. For purely illustrative purposes only and based on the total equity of the Group as at December 31, 2022, the pro forma financial effects of the Transactions on the total equity of the Group are set out below: |

Before the Transactions

(USD) | After the

(USD) | |||||||

| Share Capital | 108,633,142 | 108,633,142 | ||||||

| Retained earnings and other reserves | (101,472,924 | ) | (97,613,614 | ) | ||||

| Non-controlling interest | 6,794,617 | 6,794,617 | ||||||

| Total Equity | 13,954,835 | 17,814,145 | ||||||

Earnings. For illustrative purposes only and assuming the Capital Reduction and Distribution had been completed on January 1, 2022, being the beginning of FY2022, the pro forma financial effects as a result of the Transactions on the earnings of the Group at FY2022 are set out below:

| Before the Transactions | After the Transactions | |||||||

| Earnings / (Loss) (USD ‘000) | (56,315 | ) | (48,299 | ) | ||||

| Number of Shares in issue | 24,774,449 | 24,774,449 | ||||||

| Earnings / (Loss) per Share (USD) | (2.27 | ) | (1.95 | ) | ||||

NTA. For illustrative purposes only and assuming that the Capital Reduction and Distribution had been completed on December 31, 2022, being the end of FY2022, the pro forma financial effects of the Transactions on the NTA of the Group are set out below:

| Before the Transactions | After the Transactions | |||||||

| NTA (USD ‘000) | 6,038 | 9,898 | ||||||

| Number of Shares in issue | 24,774,449 | 24,774,449 | ||||||

| NTA per Share (USD) | 0.24 | 0.24 | ||||||

Gross Gearing.3 For illustrative purposes only and assuming that the Capital Reduction and Distribution had been completed on December 31, 2022, being the end of FY2022 , the pro forma financial effects of the Transactions on the gross gearing of the Group are set out below:

| Before the Transactions | After the Transactions | |||||||

| Total short-term and long-term debt (USD ‘000) | 8,515 | 8,515 | ||||||

| Shareholders’ equity attributable to the Company (USD ‘000) | 13,955 | 10,096 | ||||||

| Gross gearing (times) | 0.61 | 0.84 | ||||||

After the Capital Reduction and Distribution, the Company believes the continued cash flow generated from its operations and financial resources will be able to support its foreseeable near-term investment and operational needs.

The pro forma unaudited consolidated balance sheet of the Group before and after the Transactions, based on the unaudited consolidated balance sheet of the Group as at December 31, 2022, is set out in this Report.

No Adjustments in Options and Awards. The Board has determined that, in its opinion, no adjustments are required to be made to the terms of the outstanding Options and Awards consequent upon the Capital Reduction and Distribution, under the respective rules of the Share Option Plans.

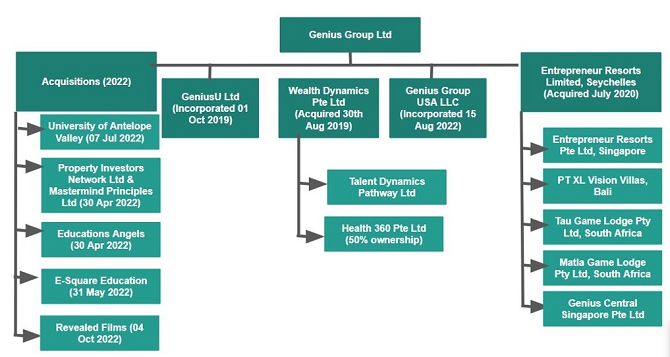

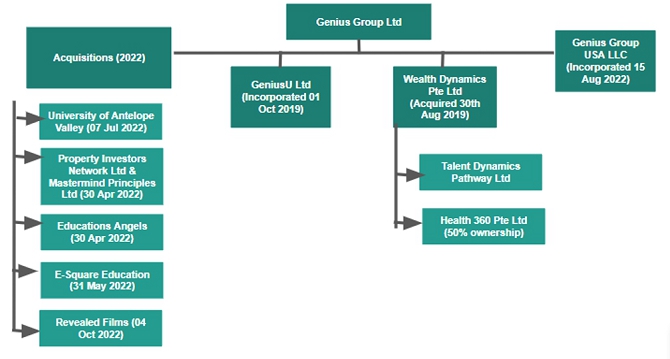

Group Structure after the Capital Reduction and Distribution. Following the completion of the Capital Reduction and Distribution, if effected, the Company will no longer hold any shares in ERL and accordingly, ERL will cease to be a subsidiary of the Group.

3 “Gross gearing” means the ratio of total short-term and long-term debt to shareholders’ equity attributable to the Company.

Before the Capital Reduction and Distribution

After the Capital Reduction and Distribution

Future Plans of the Company and ERL

At present, ERL already operates on an arms-length basis in its commercial arrangements with the Company, whereby ERL operates as a hospitality company and hosts entrepreneur courses at its locations, charging for accommodation and food and beverage. Traditionally, in education and training companies, costs relating to venue hire and catering form a large part of students’ spending and often involve a high cost of sale for these companies. The programs that the Company runs which have historically been hosted at ERL’s venues include the following:

| (i) | ERL has hosted events and courses run by the Company live at ERL’s venues, including the Global Entrepreneurs Summit, Global Investors Summit and Global Educators Summit; | |

| (ii) | ERL’s resorts in South Africa and Bali have received bookings from the Company’s partners and faculty for courses and retreats, including the Impact Investor Retreat, Wealth Dynamics Masters and Young Entrepreneurs Academy; and | |

| (iii) | venue partners from the Company’s partner community have applied to launch new campus venues in countries around the world, including in Japan, Australia, Greece and England. |

On completion of the Capital Reduction and Distribution, the arms-length arrangements between ERL and the Company for ERL to host events and courses organized by the Company will continue on a similar basis to ensure a smooth continuation of the business and operational relationships between ERL and the Company.

Following the proposed Capital Reduction and Distribution, it is anticipated that ERL will operate with the following plan and structure:

Strategic Plan: ERL has a strategic plan to grow its three location models through a combination of company-operated and licensed operations. These three location models include:

| (a) | its Genius Café model, with its current company-operated location in Sanur, Bali; | |

| (b) | its Genius Central model, with its current company-operated location in Singapore; and | |

| (c) | its Genius Resort model, with its three company-operated locations: Vision Villa Resort in Gianyar, Bali, Tau Game Lodge and Matla Private Lodge in Madikwe Game Reserve, South Africa. |

ERL is currently in discussions with licensees to open new locations and will continue with these discussions and expansion plans.

Board Structure: ERL has a separate board of directors from the Company, and ERL’s board of directors meets quarterly and is responsible for ensuring ERL’s compliance as a public company with any applicable laws and the listing rules of the MERJ. ERL’s board of directors include Roger James Hamilton, Dennis Owen Du Bois, Vilma Lisa Bovio and Jeremy Justin Harris. Following the Spinoff, these directors will continue to serve on ERL’s board of directors.

Management Team and Staffing: ERL employs 171 staff across Indonesia, Singapore and South Africa. ERL operates independently of the Company and will continue to operate independently of the Company following the Spinoff.

Net Assets, Contracts and Intellectual Property: ERL has managed and maintained separate audited accounts and bank accounts for each of its companies and has been compliant with all statutory filings as a public company listed on MERJ. ERL has also maintained its own lease contracts, supplier contracts, employment contracts, asset registries and operating licenses separately from the Company, and is the registered holder of trademarks related to ERL’s brands. This enables ERL’s balance sheet, as well as ERL’s existing commercial and legal relationships, to be maintained with minimal modification following the Spinoff.

Administrative Procedures for the Capital Reduction and Distribution. The following paragraphs set out the administrative procedures for the Capital Reduction and Distribution, if effected.

Books Closure Date. An announcement will be made by the Company on its website and lodged by the Company with the SEC to notify Shareholders of the Books Closure Date in due course.

Shareholders should note that the Capital Reduction and Distribution will only be effective upon the lodgment of a copy of the Order of Court approving the Capital Reduction and Distribution with ACRA. Accordingly, if the Board is of the view that it would not be in the best interests of the Company to effect the Capital Reduction and Distribution (for example, due to the then prevailing market or economic conditions or for any other reason), the Board may decide not to lodge a copy of the Order of Court approving the Capital Reduction and Distribution with ACRA and will make an announcement to that effect and take all necessary steps and action to terminate the Capital Reduction and Distribution exercise.

Entitlement. For illustration purposes only, assuming that the Company has the Projected Share Capital as at the Books Closure Date, pursuant to the Capital Reduction and Distribution, Entitled Shareholders would be entitled to receive approximately 0.26 Relevant ERL Shares (subject to paragraph 4.11.7 below) for each Share held as at the Books Closure Date.

Such figures in relation to the entitlement per Share pursuant to the Capital Reduction and Distribution have been rounded down to two decimal places and are provided for illustration purposes only. The final entitlement per Share pursuant to the Capital Reduction and Distribution will depend on the total number of issued Shares as at the Books Closure Date.

Scripless Shares. In the case of Entitled Shareholders being Depositors, entitlements to the Distribution pursuant to the Capital Reduction and Distribution will be determined on the basis of the number of Shares standing to the credit of their respective Securities Accounts as at the Books Closure Date.

Entitled Shareholders who are Depositors and who are Excluded Overseas Shareholders will have cheques for payment, in USD, of their respective full entitlements to the Distribution dispatched to them by the Depository by ordinary post at such Entitled Shareholders’ own risk, or in such other manner as they may have agreed with the Depository for the payment of dividends or other distributions, within 15 Market Days of the Effective Date.

Scrip Shares. In the case of Entitled Shareholders not being Depositors, entitlements to the Distribution pursuant to the Capital Reduction and Distribution will be determined on the basis of their holdings of Shares appearing in the Register of Members of the Company as at the Books Closure Date.

Entitled Shareholders who are not Depositors and who are Excluded Overseas Shareholders will have cheques for payment, in USD, of their respective full entitlements to the Distribution dispatched to them by ordinary post at such Entitled Shareholders’ own risk, within 15 Market Days of the Effective Date.

Shareholders not being Depositors who wish to deposit their Shares with the Depository prior to the Books Closure Date must deliver their existing share certificates in respect of their Shares, together with the duly executed instruments of transfer in favor of the Depository, at least 12 Market Days prior to the Books Closure Date in order for their Securities Accounts maintained with the Depository to be credited with the relevant Shares prior to the Books Closure Date.

Investors who hold Shares through a Depository Agent or finance company. In the case of investors who hold Shares through a Depository Agent or finance company (the “Beneficial Holders”), such Beneficial Holders’ entitlements to the Distribution will be determined on the basis of the number of Shares held by the Depository Agents or the finance companies (as the case may be) on behalf of each such Beneficial Holder as at the Books Closure Date.

MERJ Securities Account. ERL intends to move its primary listing from the SME Board on MERJ to Upstream, a MERJ Exchange market. Shareholders (save for Excluded Overseas Shareholders) will be required to open an account on Upstream by:

downloading the Upstream application from their preferred digital application marketplace, links to which are available at https://upstream.exchange/;

creating an account with Upstream by tapping on “sign up”;

completing a simple ‘Know Your Customer’ verification by tapping the ‘Settings’ icon on the home screen of the Upstream application and tapping “KYC”; and

depositing funds into their account held with Upstream via credit card, debit card, PayPal, USDC stablecoin or bank transfer.

Ahead of the Spinoff, Shareholders (save for Excluded Overseas Shareholders) will be duly notified of the instructions with respect to the crediting of the Relevant ERL Shares.

Overseas Shareholders. The circulation of this Circular and the distribution of the Relevant ERL Shares may be prohibited or restricted (either absolutely or subject to various securities requirements, whether legal or administrative, being complied with) in certain jurisdictions under the relevant securities laws of those jurisdictions. Overseas Shareholders are required to inform themselves and to observe any such prohibition or restriction at their own expense and without any liability to the Company.

Where the Directors are of the view that the distribution of the Relevant ERL Shares pursuant to the Distribution to any Entitled Shareholders who are Overseas Shareholders may infringe any applicable law or securities regulation in any country, or necessitate compliance with conditions or requirements imposed by the applicable laws or securities in any country which the Directors regard as onerous by reasons of costs, delay or otherwise (each such country, an “Excluded Country”), the Relevant ERL Shares will not be distributed to such Shareholders (such Shareholders, “Excluded Overseas Shareholders”). Excluded Overseas Shareholders include any Entitled Shareholder with a registered address (as recorded in the Register of Members of the Company or in the Depository Register) in any jurisdiction in which a distribution of the Relevant ERL Shares may not be lawfully made.

Subject to compliance with applicable laws and regulations, arrangements will be made for the distribution of the Relevant ERL Shares which would otherwise be distributed to the Excluded Overseas Shareholders pursuant to the Distribution to such person(s) as the Directors may appoint to sell such Relevant ERL Shares, and thereafter, the net proceeds of such sale, after deducting for all dealings and other expenses in connection therewith, shall be distributed proportionately among such Excluded Overseas Shareholders according to their respective entitlements to the Relevant ERL Shares as at the Books Closure Date, in full satisfaction of their rights to the Relevant ERL Shares which they would otherwise have become entitled to under the Distribution. No Excluded Overseas Shareholders shall have any claim whatsoever against the Company and/or ERL in connection therewith.

Any Shareholder whose registered address (as recorded in the Register of Members or in the Depository Register) is in an Excluded Country or who has provided the Depository or the Share Registrar, as the case may be, with an address in an Excluded Country for the service of documents or notices, or who is located or resident in any jurisdiction in which a distribution of the Relevant ERL Shares pursuant to the Distribution may not be lawfully made, is required to notify the Company in writing of such fact no later than five Market Days prior to the Books Closure Date. Upon being notified of such fact, the Company will regard such Shareholder as an Excluded Overseas Shareholder.

In the absence of any such notification, each Entitled Shareholder whose registered address (as recorded in the Register of Members or in the Depository Register) is in the United States of America as of the Books Closure Date or who has provided the Depository or the Share Registrar, as the case may be, with an address in the United States of America for the service of documents or notices shall be deemed to represent and warrant to the Company that he is not located or resident in any jurisdiction in which a distribution of the Relevant ERL Shares pursuant to the Distribution may not be lawfully made (including any Excluded Country).

Stamp Duty. The Company will bear any stamp duty chargeable (if any) for the transfer of the Relevant ERL Shares from the Company to the Shareholders pursuant to the Capital Reduction and Distribution.

Compliance with disclosure regulations. The Company is a foreign private issuer as defined in Rule 3b-4 of the Securities Exchange Act of 1934, and as a result, the Company is not required to comply with U.S. proxy rules or file a Schedule 14A with the SEC, all pursuant to Rule 3a12-3b of the Securities Exchange Act of 1934. Instead, this Circular complies with Singapore laws and regulations and all disclosures are provided consistent with the Act.

DIRECTORS’ AND SUBSTANTIAL SHAREHOLDERS’ INTERESTS

Directors’ Interests. As at Aug 31, 2023, the Directors’ interests in Shares as recorded in the Register of Directors’ Shareholdings are as follows:

| Number of Shares | No. of Shares comprised in | |||||||||||||||||||

| Directors | Direct Interest | % | Deemed Interest | % | outstanding Awards | |||||||||||||||

| Roger James Hamilton (1) | 9,772,446 | 13.30 | % | - | - | 74,592 | ||||||||||||||

| Suraj Prakash Naik | 255,918 | 0.36 | % | - | - | 9,708 | ||||||||||||||

| Richard Jay Berman | 6,667 | 0.01 | % | - | - | 180,000 | ||||||||||||||

| Lim Kah Wui | 7,967 | 0.01 | % | - | - | - | ||||||||||||||

| Gong Ling Jun Anna | 6,000 | 0.01 | % | - | - | - | ||||||||||||||

Substantial Shareholders’ Interests. As at the Latest Practicable Date, the interests of the substantial Shareholders in Shares as recorded in the Register of Substantial Shareholders are as follows:

| Number of Shares | ||||||||||||||||

| Substantial Shareholders | Direct Interest | % | Deemed Interest | % | ||||||||||||

| Roger James Hamilton (1) | 9,772,446 | 13.30 | % | - | - | |||||||||||

| Simon Zutshi | 2,959,518 | 4.03 | % | - | - | |||||||||||

(1) – Out of the 9,772,446 beneficially owned ordinary shares, 393,042 shares will be transferred back to the Company and cancelled in the future as per previous agreements between the Company and Mr. Hamilton

MATERIAL LITIGATION

As at the Latest Practicable Date, the Directors are not aware of any ongoing litigation, claims or proceedings pending or threatened against the Company or any of its subsidiaries or any facts likely to give rise to any litigation, claims or proceedings which, in the opinion of the Directors, might materially and adversely affect the financial position of the Company and its subsidiaries taken as a whole.

RISK FACTORS IN RELATION TO ERL

Entitled Shareholders (other than the Excluded Overseas Shareholders who will receive their full entitlements to the Distribution, if effected, in cash) will receive Relevant ERL Shares as part of their entitlements to the Distribution, if effected. Shareholders should therefore carefully consider and evaluate the following considerations, together with all of the other information contained in this Circular, when deciding whether to vote in favor of the Special Resolution relating to the Capital Reduction and Distribution at the EGM. The following risk factors relate principally to ownership of the Relevant ERL Shares, the possible adverse effect of the Capital Reduction and Distribution on the Company, the risks relating to Seychelles and the business and industry of the Group in general, in connection with the Capital Reduction and Distribution, if effected.

If any of the considerations and uncertainties develops into actual events, the business, financial condition and/or the value of ERL could be materially and adversely affected. In such circumstances, Shareholders who receive the Relevant ERL Shares pursuant to the Capital Reduction and Distribution, if effected, may lose all or part of their investment in ERL.

The risk factors below may contain statements relating to or interpretations of Seychelles laws and regulations. Such statements are not to be regarded as advice on the laws and regulations of Seychelles, and/or the differences between these laws and the laws of any jurisdiction. The risk factors do not purport to be a comprehensive analysis of all consequences, whether legal, tax or otherwise, relating to the ownership of the Relevant ERL Shares. In addition, Shareholders should note that the laws and regulations applicable to ERL may change and any change may be retroactive to the Effective Date. The laws and regulations are also subject to various interpretations and the relevant authorities or the courts may disagree with the interpretations, explanations or conclusions set out below, if any. Shareholders are advised to seek independent legal, financial, tax or business advice.

RISKS RELATING TO OWNERSHIP OF RELEVANT ERL SHARES

It is unclear whether the Relevant ERL Shares will have liquidity

The Relevant ERL Shares are listed on the MERJ. The liquidity of any market for the Relevant ERL Shares will depend on a number of factors, including: (i) the number of shareholders of the securities; (ii) the performance and financial condition of ERL; (iii) the market for similar securities; (iv) the interest of traders in making a market for the Relevant ERL Shares and (v) regulatory developments in the industries in which ERL are involved. We cannot assure you that the market, if any, for the Relevant ERL Shares will be free from disruptions or that any such disruptions may not adversely affect your ability to sell the Relevant ERL Shares. Therefore, we cannot assure you that you will be able to sell your securities at a particular time or that the price you receive when you sell will be favorable.

ERL is subject to corporate disclosure requirements which may not be equivalent to the NYSE’s corporate disclosure requirements

As a Seychelles public listed company listed on the MERJ, ERL is required to comply with its articles of association (a copy of which is available for inspection at the Company’s registered office), the laws of Seychelles (including the Seychelles Securities Act, 2007) and the listing rules of the MERJ. The interests of Shareholders who receive Relevant ERL Shares will be protected to the extent provided for under the laws of Seychelles and ERL’s articles of association. Shareholders are advised to read ERL’s articles of association carefully before deciding whether to retain their investment in ERL.

However, it is unclear whether, and we are not able to assure Shareholders that, the disclosure requirements and standards imposed on ERL by the MERJ Exchange are equivalent to or as stringent as those which the Company is subject to under the Act, the listing rules of the NYSE, and the regulations enforced by the SEC. As such, ERL may not have obligations to keep ERL Shareholders fully informed of material information concerning ERL in the manner and to the extent that the Company has, and ERL Shareholders may not receive information on ERL that ERL Shareholders may consider relevant to their investment in ERL in the manner and to the extent that they are accustomed to expect from the Company. Shareholders who wish to vote in favor of the Special Resolution relating to the Capital Reduction and Distribution should know that they will hold or own securities in a company in respect of which they may have limited information.

Control of ERL by significant shareholders may limit other shareholders’ ability to influence the outcome of decisions requiring the approval of ERL Shareholders

Upon the completion of the Capital Reduction and Distribution, it is anticipated that Roger James Hamilton will own directly or indirectly, at least approximately 22.05 per cent. of the issued share capital of ERL. As a result, Roger James Hamilton will be able to exercise significant influence over matters requiring ERL Shareholders’ approval, including the election of directors and the approval of significant corporate transactions.

There is no assurance that ERL will declare dividends on the Relevant ERL Shares

ERL’s ability to declare dividends is dependent on many factors, including applicable laws and regulations, ERL’s financial condition, the results of its investments, its capital needs and its investment plans. Further, ERL’s ability to declare dividends may be dependent on the dividends ERL receives from its investments in its subsidiaries (or other future investee companies). The ability of such subsidiaries (or other future investee companies) to declare dividends and other distributions to ERL would, in turn, depend on, amongst other things, their respective earnings and cashflows, and also be subject to the applicable laws and regulations of the relevant jurisdictions ERL’s subsidiaries operate in.

As such, there is no assurance that ERL will declare dividends nor is there any indication of the level of dividends that ERL Shareholders can expect from the Relevant ERL Shares.

ERL may require additional financing

In the future, ERL may require additional financing due to changed business conditions or other future developments, including any investments or acquisitions which ERL may decide to pursue. It is not possible to predict the amount of funds required by ERL in the near future. However, if the future investments or acquisitions are carried out on a large-scale basis, ERL may seek to issue additional equity or obtain additional debt financing. The issuance of additional equity may result in a dilution of ERL Shareholders’ shareholding in ERL. Additional debt financing would result in increased debt service obligations and may result in operating and financial covenants which may restrict ERL’s operations. There is also no assurance that ERL will be able to obtain any financing at all or on terms acceptable to ERL.

RISKS RELATING TO THE POSSIBLE ADVERSE EFFECT OF THE CAPITAL REDUCTION AND DISTRIBUTION ON ERL

ERL’s separation from the Group

Following the completion of the Capital Reduction and Distribution, as an independent company, ERL’s ability to satisfy its obligations and achieve profitability will be solely or substantially dependent upon the future performance of the ERL Group. By separating from the Group, the ERL Group will no longer be able to rely upon the capital resources and cash flows of the Group.

ERL may not be able to successfully implement the changes necessary to operate independently and separately from the Group, and may incur additional costs operating independently, which may have a negative effect on ERL’s business, results of operations and financial condition.

Copies of ERL’s annual reports for FY2019, FY2020 and FY2021 are available for inspection at the Company’s registered office. The historical financial results of ERL are not indicative of the future financial position of ERL and do not take into account the possible negative effects of the Capital Reduction and Distribution on ERL’s subsidiaries.

ERL may incur negative effects as a result of the Capital Reduction and Distribution

There can be no assurance that ERL’s business and operational objectives could be achieved or that ERL will not incur negative effects from their separation from the Group. By separating from the Group, there is also a risk that ERL may be more susceptible to market fluctuations and other adverse events than they would have been had they still been part of the Group.

RISKS RELATING TO SINGAPORE, INDONESIA AND SOUTH AFRICA

ERL is an investment holding company holding investments in Singapore, Indonesia (Bali) and South Africa. Accordingly, all or a substantial portion of ERL’s earnings is expected to derive from the business and operation of these subsidiaries, and ERL is therefore susceptible to any risks inherent in or relating to the countries in which these subsidiaries operate in.

PRO FORMA UNAUDITED CONSOLIDATED BALANCE SHEET OF THE GROUP BEFORE AND AFTER THE TRANSACTIONS

| Before the Transactions | After the Transactions | |||||||

| 2022 (USD ‘000) | 2022 (USD ‘000) | |||||||

| Summary Balance Sheet Data: | ||||||||

| Total current assets | 24,2506 | 21,718 | ||||||

| Total non-current assets | 67,009 | 58,982 | ||||||

| Total Assets | 91,260 | 80,701 | ||||||

| Total current liabilities | 23,377 | 18,966 | ||||||

| Total non-current liabilities | 57,927 | 51,565 | ||||||

| Total Liabilities | 77,305 | 70,532 | ||||||

| Total Shareholders’ Equity | 13,955 | 10,169 | ||||||

| Total Liabilities and Shareholders’ Equity | 91,260 | 80,701 | ||||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| GENIUS GROUP LIMITED | ||

| Date: September 5, 2023 | ||

| By: | /s/ Roger James Hamilton | |

| Name: | Roger James Hamilton | |

| Title: | Chief Executive Officer and Chairman (Principal Executive Officer) | |