July 10, 2024

United States Securities and Exchange Commission

Division of Corporation Finance

Office of Technology

100 F Street, NE

Washington, DC 20549

Attn: Marian Graham, Esq. and Jeff Cauten, Esq.

Genius Group Limited

Registration Statement on Form F-1

Filed May 29, 2024

File No. 333-279795

Gentlepersons:

We have received a letter dated July 3, 2024 (the “Letter”) from the staff of the Securities and Exchange Commission (the “SEC” and, the staff of the SEC, the “Staff”) to my direction, as Chief Executive Officer of Genius Group Limited (the “Company”), relating to the Amendment No. 2 to the Company’s Registration Statement on Form F-1 filed by the Company on June 25, 2024 (the “Registration Statement”). The Staff’s comments from the Letter are included below in bold type for convenience of reference, which is followed by the Company’s response thereto.

Amendment No. 2 to Registration Statement on Form F-1

Summary Combined Unaudited Pro Forma Financial Data and Audited Consolidated Financial Data

Footnotes and pro forma adjustments, page S-11

| 1. | We note that you acquired approximately $25.8 million of intangible assets in the FatBrain acquisition. Please revise to include the related impact on the pro forma statement of operations. Refer to Rule 11-02(a)(6)(i)(B) of Regulation S-X. Also, revise to include pro forma per share information. |

Response:

We have revised the Pro Forma working to re-calculate the impact on Balance Sheet and Statement of Operations. We have also included pro forma per share information on Statement of Operations.

The total acquisition value of the acquisition was approximately $29.3 million broken down as follows:

Acquired Assets

| Intellectual Property | $ | 7,867,848 | ||

| Customer contracts and customer relationship | 7,399,746 | |||

| Other intangible assets | 6,984,946 | |||

| Total Intangible Assets Subject to Amortization | 22,252,540 | |||

| Goodwill | 18,171,320 | |||

| Total Intangible Assets Acquired | 40,423,860 | |||

| Net asset acquired exclusive of other intangible assets (see table below) | 3,904,032 | |||

| Additional liabilities acquired | (15,000,000 | ) | ||

| Total Net Assets Acquired | $ | 29,372,892 |

| Descriptions | Amount | |||

| Cash and cash equivalents | $ | 6,886,013 | ||

| Accounts receivable, net | 3,488,160 | |||

| Prepaid expenses and other current assets | 3,553,991 | |||

| Other assets | 330,436 | |||

| Accounts payable | (3,456,593 | ) | ||

| Deferred revenue | (2,189,960 | ) | ||

| Loans payable - current portion | (3,900,015 | ) | ||

| Other liabilities | (807,999 | ) | ||

| Net Assets Acquired Exclusive of Other Intangible Assets | $ | 3,904,032 | ||

The total net assets acquired is $10,888,978 which includes $3,904,032 net assets acquired exclusive of intangible assets and $6,984,946 intangible assets that ties with the audited financial statement of Prime Source Group.

The consideration provided for the above assets was as follows:

| Fair market value of Company shares issued | $ | 29,327,892 |

The acquisition of the Intangible assets from FatBrain AI resulted in the following impact on the Pro Forma Statement of Operations:

| Intangible Assets | Method of Amortization | Remaining

Economic Life | Amount of Intangible Assets | Amortization Expense | ||||||||

| Intellectual Property | Straight Line | 3 Years | $ | 7,867,848 | $ | 2,622,616 | ||||||

| Customer Contracts and Customer Relationships | Straight Line | 4 Years | 7,399,746 | 1,849,936 | ||||||||

| Other Intangible Assets* | Straight Line | 5 – 7 Years | 6,984,946 | - | ||||||||

| Total | $ | 22,252,540 | $ | 4,472,553 | ||||||||

* Amortization of Other Intangible Assets is included in the Prime Source Group’s financial statement.

We have further calculated the income tax impact of the above adjustment to reflect on the Pro Forma Statement of Operations:

| Amortization amount | $ | 4,472,553 | ||

| Income tax rate | 21 | % | ||

| Income tax | $ | 939,236 |

FatBrain AI Financials, page S-12

| 2. | Please explain your statement on page S-12 that FatBrain AI’s financial statements are derived from the audited financial statements of Prime Source Group. Explain, in detail, the relationship between these entities and clarify whether FatBrain AI comprises the entire Prime Source Group. If not, revise to include audited financial statements for FatBrain AI only. |

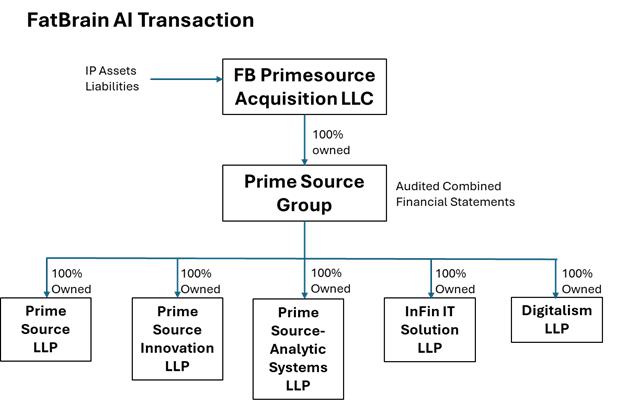

Response: The FatBrain AI transaction represents the acquisition of FB Primesource Acquisition LLC which consists of the following:

| 1) | Prime Source Group - 100% stock ownership of five companies organized under Kazakhstan law and operating in Kazakhstan. The combination of those five companies is called Prime Source Group and the audited financial statements of Prime Source Group are included as Exhibit 21.1 (b) and 21.1 (c) to the Registration Statement. | |

| 2) | IP Assets of LZGI (seller) contributed to the transaction per the Sale and Purchase agreement. | |

| 3) | Liabilities of LZGI (seller) contributed to the transaction per the Sale and Purchase agreement. |

Thus, the audited Prime Source Group financial statements cover the operating assets of the five entities.

| 3. | Please address the following as it relates to the Independent Auditor’s report for FatBrain AI: |

| ● | Confirm that the financial statements were audited in accordance with U.S. generally accepted audited standards (U.S. GAAS) and revise the reference to International Standards on Auditing to instead refer to U.S. GAAS. | |

| ● | Revise to either provide an audit report that includes an opinion as to whether the financial statements comply with IFRS as issued by the IASB or provide a reconciliation from IFRS to U.S. GAAP in the financial statement footnotes. |

Response:

| ● | We confirm that the financial statements were audited in accordance with the International Financial Reporting Standards (IFRS) and not U.S. GAAS. | |

| ● | We have revised the exhibits to include the updated audit opinion which states that the financial statements comply with IFRS as issued by IASB. Based on our detailed review of the audited financial statements, we identified no material differences between the current IFRS financial statement presentation vs U.S. GAAP presentation would have been. |

Exhibits

| 4. | Please revise to include a consent that is signed by the accounting firm as opposed to a partner of the firm. |

Response: We have updated the exhibit in relation to the above comment to include sign off from accounting firm’s name as opposed to a partner of the firm.

| 5. | Please revise the consent of your independent registered public accounting firm to refer to the audit of Genius Group’s consolidated financial statements as of December 31, 2023 and 2022 and each of the years in the three years ended, December 31, 2023. |

Response: We have updated the consent of our independent registered public accounting firm to refer to the audit of Genius Group’s consolidated financial statements as of December 31, 2023 and 2022 and each of the years in the three years ended, December 31, 2023.

In connection with responding to the Staff’s comments, the Company acknowledges that it is responsible for the accuracy and adequacy of the disclosures in its filings, notwithstanding any review, comments, action or absence of action by the Staff.

We believe that the response above fully addresses the comment contained in the Letter. If you have any questions regarding the Registration Statement or the above response, please contact the undersigned at roger@geniusgroup.net and the Company’s U.S. counsel, Jolie Kahn, at (516) 217-6379 or joliekahnlaw@sbcglobal.net.

| Sincerely, | |

| /s/ Roger Hamilton | |

| Roger Hamilton | |

| Chief Executive Officer |

cc:Jolie Kahn